The Cardinal Crisis

This World press photo shows a gun-wielding deputy sheriff's officer making his way cautiously through a house to make sure its bank-evicted residents have abandoned their foreclosed home.

Credit: Anthony Suau/Time Magazine

Jobs, The Economy, Foreclosures & Real Estate:

Austerity Coming To America?

Plus,

British Graduates Face Bleak Economic Times Ahead

Also,

Accused German Hedge Fund Manager Dead in Spain?

And,

Goldman Sachs: "Lying Liars?"

Plus,

Mundane World Forecast: 2010-2015

By Theodore White; mundane Astrolog.S

Θεόδωρος

For some time, I have been forecasting and warning that 2010 will be an historic year.

As July 2010 begins, the world is now in the first phases of the Cardinal T-Square developing with tighter orbs configuring among the outer planets involved: Mars, Jupiter, Saturn, Uranus, and Pluto.

This same T-Square, with Saturn, Uranus, and Pluto, in cardinal signs, took place at the beginning of the decade of the 1930s.

It has the effect of powerfully depressing economies, and stressing employment levels to the bare minimum.

Saturn enters the 29-degree of Virgo on July 7th, and is at the end of a 2.5-year transit in that Sign. The planet has been transiting near the nadir of world regions in late June and early July.

Saturn will re-enter tropical Libra officially on July 21, 2010 for a 2.5-year transit.

The strength of Saturn's transit now peaks at the last degree of tropical Virgo and brings with it malefic inclinations that tend to lean toward loss for those under Saturn's influences.

Tens of millions of people worldwide are out of work; foreclosures continue to rise, and the great majority of people searching for jobs is at its highest levels since the early years of the Great Depression of the early 1930s.

For every one job opening in the United States there are an estimated five people looking for that position. In the United Kingdom, there are 70 applicants for every single job listed.

These numbers increase as the cardinal T-square now forms in the summer of 2010 in the northern hemisphere.

The forces at work now during the Cardinal Crisis are mainly in confusion, and disarray as millions of residential foreclosures continue unabated in the United States, while commercial real estate and office vacancy rates keep climbing.

What is clear is that the Bank Crisis is ongoing with families being thrown out into the street unable to keep up with debt, overvalued housing prices, and mortgages while few judges feel the need to squash foreclosure eviction orders in a economic climate that clearly does not favor recovery.

Much of this comes from ignorance of astrological transits, and the internal, regulatory, and political neglect which fostered years of widespread financial corruption, greed, and all manner of transgression.

The current economic crisis, in my mundane view, is about to become an economic depression.

This is where many nations slip into painful levels austerity for years, while other countries experience what some economists now call a "recovery-less recovery."

The way out of this is simple, in my mundane view:

What is happening is that we are experiencing a major generational transition, from the Baby Boomers, or the post-WWII generation, to that of post-Cold War generation, called Generation X.

These children, born in the 1960s and 1970s, are now poised to become the new establishment.

I continue to state that what is really happening is that the Pluto in Leo generation, now on the way out as establishment, is leaving behind multiple and huge gaps in the economic life of the world that must be solved, and then resolved, by a new generation.

The neglect, and outright corruption of the Baby Boomer generation as establishment is unforgivable given the spectrum and depth of pain inflicted on tens of millions of families worldwide and in the United States.

It is obvious that many governments, along with bankers, and policymakers, the great majority who are of the Baby Boomer generation, have decided that "austerity" and "belt-tightening" is the way to go.

However, these are the same people, from the same generation, that caused the crisis in the first place.

It is actually time for them to go.

It is time for the Baby Boomer generation to start their retirements, and that is exactly what global planetary transits are about to make happen.

I have been forecasting this for sometime, because it is what I have foreseen.

Individual Baby Boomers continue to say they are appalled and ashamed of what their own generation has wrought as the establishment. Some seek to distance themselves from what they know will be a harsh reckoning against their generation in the decade to come.

The Pluto in Leo generation, in their angst and dysfunction, will have left behind them a mess the likes of which will boggle the mind in the months and years ahead, and which reflects back the ruins of whole economies of scale.

The resulting social decay, rising crime, along with the economic and emotional depression will require a new generation to infuse into the 2010s and 2020s a positive energy and renewed spirit - along with proper common sense management - something that has been entirely lacking from the Pluto in Leo generation.

To proceed into the future means to dump the outworn methods, widespread neglect, and negative baggage that comes from the fear and angst of the Baby Boomer generation.

Meanwhile, the summer and fall seasons of 2010 in the northern hemisphere will continue to experience higher, and deeper unemployment numbers expanding across several important sectors which may not recover for many years.

I expect the second half of 2010 to be one of the roughest stretches of time for the unemployed, the business sector and residential & commercial real estate.

The economic crisis will continue into 2011 and 2012 under the Jupiter/Saturn opposition. These years, along with 2010, are the years when the real estate market will experience a full collapse.

My forecast is based on the power of the Cardinal T-Square, mainly the waning square from Saturn to Pluto, and the opposition of both Jupiter, and Uranus to Saturn this year.

This T-square configuration inclines the business cycle toward contraction, based on the waning influences and poor choices of the Baby Boomer generation since they became the establishment in 1993.

The consequences of this are far-reaching.

The tens of millions of people affected by the crash of the real estate and housing markets are also voters, and citizens who, by their direct experiences, will become radicalized against the very system they once supported and believed was honest and just.

No more.

The world transits confirm that in the years ahead, the bankers, corporations, associations, their lobbyists, judges, and supporters of a corrupted system that has foreclosed on millions of families, shuttered tens of thousands of healthy businesses, ruined lives, neighborhoods and communities, will, in the near future come to seriously regret their fraud against the very people who make up the totality of a robust, and healthy economic life.

I wish I could be more positive, but by my mundane calculations of the configurations of the planets relative to the Earth, and their correlations to events, I find that things will get worse under the Cardinal T-Square, and Cardinal Cross world transits.

I have forecasted many times previously that the second half of 2010, into the first quarter of 2011, will be very difficult for millions of people who currently are underwater with their mortgages, and for those who have lost jobs and continue to look for work in a severely contracted economy.

The corruption, greed, and outright stupidity of those involved in the policy-making, regulatory, educational and financial community has led much of the world to the precipice of a full-blown economic depression.

Astrologically, these times were known by some mundane astrologers, but few people listened to our warnings, or believed it was even possible.

It is the power of the inclinations of the Saturn, Uranus, Pluto cardinal T-Square, not seen since the early years of the Great Depression, that has returned.

Saturn's waning square to Pluto will be now be re-activated this summer. Along with the opposition from Jupiter, and Uranus to Saturn, the power of the configuration on Earth will be, at times harsh, and also unrelenting.

The consequences and recriminations from 18 years of corruption, greed, and outright fraud which has led tens of millions of people into desperation and loss will lead to angry years ahead against the old establishment that started it all.

It has been, and continues to be my view, that President Barack Obama should have placed a moratorium on foreclosures nationwide in the United States until a full accounting of the banking crisis, and the rampant corruption within the financial community, had been tackled.

This would have prevented the losses facing tens of millions of families, and saved the economy from further depression.

But what do I know? I'm just a mundane astrologer.

It is my view that because of the ignorance, and failure of politicians, bankers, their lobbyists and associations, that the popular backlash to come will be a direct result of ignorance and pandering to forces that not only started the economic crisis, but continue to fuel it.

I have forecasted a double-dip last year for 2010, especially during the third and fourth quarters of 2010. That time has now just begun.

Losing a home to foreclosure has been, and continues to be a living nightmare for families. According to estimates, the number of American homes taken over by banks has jumped 35 percent since the first quarter of 2009.

There has already been one million bank repossessions of homes so far in 2010.

The overlooked victims of the mortgage disaster are the more than 2 million children whose families lost their homes between 2007 and 2009.

Economists estimate that another 2.5 million to 3.5 million families are at serious risk of losing their homes in 2010.

This estimate does not include the families who lost their homes by defaulting on rental payments or conventional mortgage loans.

The second half of 2010 holds the first phase of the powerful Cardinal crisis transits, and it is in this phase that most of the damage from the crash of the residential housing market will be felt full force.

I am not alone in my assessment of what is to come from the Bank Crisis, as there are others who see, at least in the medium-term, a very rough patch for tens of millions of people in the years ahead.

Consider this:

A Market Forecast That Says Take Cover?

Robert R. Prechter, Jr., CMT, is founder & president of Elliott Wave International, the world’s largest independent financial forecasting firm. If Prechter is right, one market analyst said, "We've basically got to go to the mountains with a gun and some soup cans."

Credit: Tami Chappell for The New York Times

By Jeff Sommer, New York Times

July 2, 2010 - With the stock market lurching again, plenty of investors are nervous, and some are downright bearish.

Then there’s

Robert Prechter, the market forecaster and social theorist, who is in

another league entirely.

Mr. Prechter is convinced that we have entered a market decline of staggering proportions — perhaps the biggest of the last 300 years.

In a series of phone conversations and e-mail exchanges last week, he said that no other forecaster was likely to accept his reasoning, which is based on his version of the Elliott Wave theory — a technical approach to market analysis that he embraces with evangelical fervor.

Originating in the writings of Ralph Nelson Elliott, an obscure accountant who found repetitive patterns, or “fractals,” in the stock market of the 1930s and ’40s, the theory suggests that an epic downswing is under way, Mr. Prechter said.

But he argued that even skeptical investors should take his advice seriously.

“I’m saying: ‘Winter is coming. Buy a coat,’ ” he said.

“Other people are advising people to stay naked.

"If I’m wrong, you’re not hurt.

"If they’re wrong, you’re dead. It’s pretty benign advice to opt for safety for a while.”

His advice: individual investors should move completely out of the market and hold cash and cash equivalents, like

Treasury bills, for years to come.

For traders with a fair amount of skill and willingness to embrace risk, he suggests other alternatives, like shorting the market or making bets on volatility.

But ultimately, “the decline will lead to one of the best investment opportunities ever,” he said.

Buy-and-hold stock investors will be devastated in a crash much worse than the declines of 2008 and early 2009 or the worst years of

the Great Depression or the Panic of 1873, he predicted.

For a rough parallel, he said, go all the way back to England and the collapse of the South Sea Bubble in 1720, a crash that deterred people “from buying stocks for 100 years,” he said.

This time, he said, “If I’m right, it will be such a shock that people will be telling their grand-kids many years from now, ‘Don’t touch stocks.’ ”

The Dow, which now stands at 9,686.48, is likely to fall well below 1,000 over perhaps five or six years as a grand market cycle comes to an end, he said.

That unraveling, combined with a depression and

deflation, will make anyone holding cash “extremely grateful for their prudence.”

Mr. Prechter is hardly the only market hand to advocate prudence now, but nearly everyone else foresees a much rosier future, once current difficulties are past.

For example, Ralph J. Acampora, a market analyst with more than 40 years of experience, said he moved entirely out of stocks and into cash late last month.

Now a partner at Alverita, a wealth management firm in New York, he said recent setbacks suggested that the market would drop another 10 or 15 percent, probably until September or October, before resuming another “meaningful rally.”

Over the next several years Mr. Acampora expects an “old normal market,” characterized by relatively short-lived swings that will provide many opportunities for smart investors — one that resembles the markets of the 1960s and 70s. “I’ve lived through it,” he said.

Like Mr. Prechter, he is a past president of the Market Technicians Association, the leading organization of technical market analysts, and he said that his colleague has done “some very good work.”

But Mr. Acampora doesn’t agree with Mr. Prechter’s long-term theories, either intellectually or emotionally.

The “mathematics don’t work,” Mr. Acampora said, because such a big decline would imply that individual stocks would need to trade at unrealistically low levels.

Furthermore, he said, “I don’t want to agree with him, because if he’s right, we’ve basically got to go to the mountains with a gun and some soup cans, because it’s all over.”

Still, on a “near-term” basis, he said, “We’re probably saying the same thing.”

Similarly, Larry Berman, who co-founded ETF Capital Management in Toronto and recently ended his term as the president of the technicians association, says he sees a “classic” short-term negative market trend developing now.

But he doesn’t use the Elliott Wave theory, saying Mr. Prechter is trying to “measure the market in decades, which is too long a time frame for practical trading purposes or for risk management.”

Mr. Prechter, 61, lives in Gainesville, Ga., where he runs Elliott Wave International, a forecasting and publishing firm. He graduated from Yale as a psychology major in 1971, dabbled as a singer, drummer and songwriter in a rock band and became a technical analyst for Merrill Lynch.

He became fascinated by Mr. Elliott’s writings, which suggest that the market moves in predictable if complex patterns.

Along with A. J. Frost, Mr. Prechter wrote “

Elliott Wave Principle,” a 1978 book that predicted the emergence of a great bull market — a forecast that was largely fulfilled.

By 1987, he was widely regarded as an expert in technical analysis.

Articles in The New York Times said he was known as “the market’s leading technical guru” — and more.

An article in October that year said he had “emerged as both prophet and deity, an adviser whose advice reaches so many investors that he tends to pull the market the way he has predicted it will move.”

He has far less day-to-day influence now, after years spent developing

a theory he calls “socionomics,” which holds “social moods” as the cause not only of market cycles but also of economic and political events.

A grand cycle is ending, he says, and the time for reckoning is near.

In 2002, he published “

Conquer the Crash,” which predicted misery ahead. Even so, he said in 2008 that the market would soon rally sharply — then said late last year that stocks were about to fall and that the great decline would resume.

Since 1980, the advice in his investing newsletters, when converted into a portfolio, has slightly underperformed the overall stock market but has been much less risky, losing money in only one calendar year, according to calculations by The Hulbert Financial Digest.

Mr. Prechter said he disagreed with the methodology used in these measurements, but offered none of his own.

For his part, Mr. Acampora says that the Elliott Wave has some validity as an indicator but that “it’s only part of the story” of technical market analysis, which also needs to be buttressed by economic and fundamental research.

Mr. Prechter says his unifying theory, socio-economics, is a “young science.”

“We’re quantifying it,” he said. “We’re working on it.” In the meantime, he contends, it has enabled him to “look around the corner” and prepare for a dangerous future.

Update on AXA Rosenberg

Here’s an update on the troubles at AXA Rosenberg, the quant unit of the French financial services giant AXA, which were reported

two weeks ago.

A computer programmer made a “coding error” in AXA Rosenberg’s risk management software, but the company didn’t reveal or fix it for many months.

In a letter to clients last week, AXA Rosenberg said a management shakeup had accelerated. Its co-founder, Barr Rosenberg, and its director of research, Tom Mead, resigned from the board of directors and will be leaving the company.

A review found that they had violated the firm’s ethics policy and had withheld information about the mistake, the letter said.

The executives did not respond to requests for comment.

Separately, Agustin Sevilla, global chief investment officer, stepped down from that post and will move to a “senior research” role, the letter said. He didn’t return phone messages last week.

The company said it’s bringing in a consultant to help improve risk management controls and reinforce “independent oversight.” It said it is still reviewing the coding error’s effect on investment portfolios.

~

The Elliot Wave Theory is really a study of global astrological transits, and the direct impacts on economics, the financial community, and stock markets.

I continue to forecast that the world has entered an historic period of time that will forever change the lives of tens of millions of people - all due to corruption, greed, and financial malfeasance at levels never before witnessed in modern history...

The Cardinal Crisis

Foreclosures:

A Corrupted System Keeps Churning Up The Pressure On Families

The backlog of foreclosure cases is depicted here in the scanning room at the Clerk & Comptroller's Office in Palm Beach, Florida.

Credit: Bruce Bennett/Palm Beach Post

A system I consider to be corrupted from years of abuse with little to no regulation continues to throw families out on the street.

The transit of Saturn in the last degrees of Virgo, and approaching its waning square to Pluto while opposing both Jupiter and Uranus, reflects the rising foreclosures of homes by banks which continue to show no compassion or understanding for human beings:

Two Judges & Six Case Managers Added to Push Through 52,000 Backlog of Foreclosures in Palm Beach?

By Kimberly Miller

Palm Beach Post

July 6, 2010 - WEST PALM BEACH, FLORIDA — Palm Beach County's courts have hired two senior judges and six case managers to help work through a foreclosure backlog of about 52,000 cases.

The additional employees, including four clerical assistants, began last week.

Their salaries are being paid with $640,000 — part of a one-time statewide allocation of $6 million to help clear an estimated backlog of 500,000 foreclosure cases in Florida.

The Palm Beach County Clerk and Comptroller was given $403,000 out of a statewide allocation of $3 million.

"What I hear is there are homeowners and condo owners not in foreclosure who are being hurt because properties in foreclosure aren't being maintained," said Palm Beach County Chief Judge Peter Blanc.

Palm Beach County Chief Judge Peter Blanc

Moving foreclosures through the system, Blanc said, is intended to get vacant homes back on the market and improve overall property values.

Blanc said the new employees will increase the number of summary judgments processed from 1,000 per week to 2,000.

A motion for a summary judgment is typically filed by the lender following a homeowner's answer to the foreclosure filing.

If the owner does not object to the foreclosure, it can be a quick proceeding in favor of the bank.

Homeowner activists fear increasing the rate at which summary judgments occur is unfair to borrowers, but Blanc said the court wants to be fair while also reducing the backlog.

"We want to be efficient, but not rush," Blanc said.

Palm Beach County Chief Judge Peter Blanc says the new employees will increase the number of summary judgments processed from 1,000 per week to 2,000.

~

Foreclosures Rise For Prime Loan Borrowers

Rate Has Doubled In The Past Year?

Click on Graphic To Enlarge

By Emett Pierce

May 29, 2010 -- San Diego, California -- The mortgage crisis that has shaken the nation's economy is expanding beyond the subprime market to include borrowers with prime loans and solid credit ratings, said a survey released yesterday by the Mortgage Bankers Association.

The rate of foreclosure on prime, fixed-rate mortgages doubled in the past year, said Jay Brinkmann, chief economist for the Mortgage Bankers Association.

Nearly 6 percent of such mortgages were in the foreclosure process or behind by at least one payment at the end of the first quarter.

Among all types of mortgages, the survey showed that a record 12 percent of homeowners had fallen behind on their payments or were going through foreclosure.

The report reflects a significant threat to the ailing housing market as well as the overall economy, said Mark Zandi, chief economist at Moody's Economy.com.

“As long as foreclosures are rising, house prices will decline, which will undermine household wealth,” he said.

“It will be very difficult for the economy to gain any traction. A lot more foreclosures are coming.”

Widespread layoffs and pay cuts have weakened the ability of many middle-wage households to make their monthly mortgage payments.

The expanding mortgage market meltdown began with the failure of highly leveraged subprime loans.

Such loans originally were intended for borrowers with blemished credit but fell into common usage.

Tens of thousands of loans were approved in the first half of the decade without regard to income or credit scores.

Critics say lenders lowered their underwriting standards as home prices rose beyond the reach of middle-wage earners in order to prolong the housing boom.

Until recently, many analysts said the people who were losing their homes probably took on too much debt in relation to their income.

The new survey reflects a deepening recession, with formerly solvent homeowners struggling to make ends meet.

University of San Diego economist Alan Gin said San Diego County's high job losses are contributing to the problem locally. The county's [official] unemployment rate is now 9.1 percent.

Dean Baker, an economist with the Center for Economic and Policy Research in Washington, was surprised that the quarterly report showed that 7.51 percent of prime loans in California were past due.

An additional 3.48 percent of prime loans, which go to borrowers with high credit ratings, were in foreclosure.

“That is incredible,” Baker said. “These are the good ones. These are not people who likely got in over their heads.”

Foreclosure activity in San Diego County has been fluctuating in recent months.

In April, MDA DataQuick reported 903 foreclosures in the region, an increase of 23 percent over March but a drop of 36 percent from April 2008.

There were 3,371 recorded notices of default in April, a 12 percent decline from the previous month, but a year-over-year gain of 2.2 percent.

Prime, fixed-rate loans, which go to borrowers with good credit, now represent the largest share of new foreclosures nationwide, according to the first-quarter survey.

A year ago, prime, fixed-rate loans equaled about 19 percent of foreclosure starts nationwide, Brinkmann said. Sub-prime adjustable-rate mortgage loans totaled 39 percent.

In the recent survey, prime loans totaled 29 percent of foreclosure starts and subprime adjustable [mortgages] were down to 27 percent.

About 56 percent of the increase in foreclosures and past-due loans is coming from California, Florida, Arizona and Nevada.

Brinkmann said the delinquency rate for mortgage loans in California was 9.22 percent at the end of the quarter, an increase less than one-tenth of 1 percent from the previous quarter.

No region of the country is immune from the foreclosure problem, as rising unemployment spreads.

Zandi said efforts by the Obama Administration to place distressed borrowers in affordable loans has yet to make a dent in the problem.

Economist Christopher Thornberg of Beacon Economics in Los Angeles said the situation isn't surprising, given the large number of bad loans that were made during the housing boom.

~

My forecasts, as dire as they may be, reflect the truth of what is actually happening.

To turn away from the realities of what has been, and continues to take place, is to have one's head stuck deep in the sands of ignorance.

The so-called "loan modifications" that were touted as the solution in 2009, and early 2010 is being seen as a complete failure.

~

The Cardinal Crisis

Austerity Comes to America

A Million Layoffs Ahead For State & City Government Workers?

By Robert Oak

Economic Populist

Moody's has

estimated 400,000 jobs from State, City and Local governments will be lost next year due to budget cuts. Up to 400,000 workers could lose jobs in the next year as states, counties and cities grapple with lower revenue and less federal funding, says Mark Zandi, chief economist for Moody's Economy.com.

The

Center for Budget and Priorities has the estimate much worse, a total of 900,000 jobs affected.

It will slow the economic recovery and raise the risk that the nation will fall back into recession as the loss of Americans’ spending power ripples through the economy.

States’ actions to close their $140 billion gap without more federal aid could cost the economy up to 900,000 public- and private-sector jobs.

More estimates:

Wells Fargo economist Mark Vitner expects state and local governments to cut about 200,000 workers this year if Medicaid benefits aren't extended.

That's largely why Wells Fargo cut forecasts for third-quarter economic growth to 1.5% from 1.9%.

Even if Congress extends Medicaid subsidies, Zandi expects 325,000 job cuts the next year, though Vitner says losses could be far less.

It appears much of the cuts have to do with help to the elderly and poor and Medicaid. Below is the list of cuts already

one must ask if states are not purging the roles of ineligible people and what are they doing about Medical costs?

Denying an American equipment to help them breath is truly a scary thought and this is one of the cuts listed.

The list below reveals excerpts from a

budget graph from the

Center for Budget and Priorities.

- An estimated 10,000 families in Arizona will lose eligibility for temporary cash assistance as the time limit for that assistance is cut back to 36 months from 60.

- Over 1 million low-income Arizonans will lose access to Medicaid services offered by the state, including emergency dental services, medically necessary dentures, insulin pumps, airway devices for people with chronic lung disease, gastric bypass surgery, certain hearing aids for the deaf or severely hard of hearing, and prosthetics.

- Arizona also will eliminate a host of behavioral health services for 4,000 children ineligible to receive such services through Medicaid, and will eliminate case management, therapy, and transportation services for 14,500 individuals participating in a non-Medicaid program for the seriously mentally ill.

- Georgia will eliminate as many as 284 eligibility workers who help low-income families enroll in the food stamp, Medicaid and TANF programs. Eligibility workers are being cut even as an increasing number of families are qualifying these programs due to economic hardship.

- Idaho’s Department of Health and Welfare will reduce or eliminate cash assistance to 1,250 low-income elderly adults and people with disabilities.

- A Kansas reduction in grants to Centers for Independent Living will result in a loss of services for nearly 2,800 individuals with a disability.

- Minnesota residents successfully transferring from welfare to work will see monthly cash bonuses that they receive from the state cut in half (from $50 to $25.)

- Oregon will make significant cuts to community mental health programs, reducing access to crisis services, acute psychiatric treatment, medications and case management services for 1,462 Oregonians with mental illness.

Other cuts to programs and services resulting from spending reductions in states’ 2011 budgets have already been implemented or will take effect later on in the new fiscal year:

- Colorado is cutting public school spending by $260 million, nearly a 5 percent decline from fiscal year 2010. The cut amounts to more than $400 per student.

- Because of changes that Connecticut made to its Medicaid program, on June 1, 2010, over 220,000 pregnant women, parents, caretaker relatives and disabled and elderly adults lost coverage for over-the-counter medications and nutritional supplements (with exceptions for insulin and supplies, nutritional supplements for those with feeding tubes, and prenatal vitamins.)

- Florida’s 11 public universities will raise tuition by 15 percent for the 2010-11 academic year. This tuition hike, combined with a similar increase in 2009-10, results in a total two-year increase of 32 percent.

- Georgia is cutting state funding for K-12 education for FY 2011 by $403 million or 5.5 percent. The cut has led the state’s board of education to exempt local school districts from class size requirements to reduce costs.

- The state also cut state funding for public higher education. As a result, undergraduate tuition for the fall 2010 semester at Georgia’s four public research universities (Georgia State, Georgia Tech, the Medical College of Georgia, and the University of Georgia) will increase by $500 per semester, or 16 percent. Community college tuition will increase by $50 per semester.

- In Minnesota, as a result of higher education funding cuts, approximately 9,400 students will lose their state financial aid grants entirely, and the remaining state financial aid recipients will see their grants cut by 19 percent. The state is also making a 40 percent cut to state aid for counties that funds child protective services, and services provided to disabled and vulnerable adults.

- Missouri’s fiscal year 2011 budget reduces by 60 percent funding for the state’s only need-based financial aid program, which helps 42,000 students access higher education.

- This cut could be partially restored with other scholarship money, but will still result in a cut of at least 24 percent to need-based aid. The state is also cutting by 46 percent its funding for K-12 transportation.

- The cut in funding likely will lead to longer bus rides and the elimination of routes for some of the 565,000 students who rely on the school bus system.

- Mississippi’s Department of Human Services will lay off 124 workers, 115 of them from a community-based juvenile justice facility.

- Oregon is eliminating a program that helps 2,000 elderly residents who have been diagnosed with Alzheimer’s disease or a related dementia disorder to remain in their homes rather than receiving care in an institution.

- The state is also making major cuts to state funding for in-home care services such as meal preparation and homemaking, affecting another 10,500 elderly residents.

- Oregon is also cutting funding for K-12 schools, community colleges, and pre-K programs; among other results, an estimated 585 fewer children will be able to attend pre-kindergarten in the coming school year.

- Virginia’s $700 million in cuts for the coming biennium include the state’s share of an array of school district operating and capital expenses, and funding for class-size reduction in kindergarten through third grade.

- Washington is imposing a time limit on the receipt of medical and cash assistance by people who are physically and/or mentally incapacitated and unable to work. In 2011, the limit will reduce the number of people receiving medical assistance by 2,350 and the number of people receiving cash assistance by 2,828.

- The state is also cutting a further 6 percent — on top of previous years’ cuts — from direct aid to the state’s six public universities and 34 community colleges, which will lead to further tuition increases, administrative cuts, furloughs, layoffs, and other cuts.

- The state also cut support for college work-study by nearly one-third and suspended funding for a number of its financial aid programs.

- Wyoming is cutting aid to local areas by more than half.

~

The Cardinal Crisis

Housing Markets On Verge Of Another Dive?

~ AP reports June 2010 ~

WASHINGTON (AP) -- The housing market may be on the verge of taking another plunge that could weaken the broader economic recovery.

Sales of previously occupied homes dipped in May, even though buyers could receive government tax credits.

And nearly a third of sales in May were from foreclosures or other distressed properties. That means home prices could soon be heading down after stabilizing over the past year.

Last month's sales fell 2.2 percent from the previous month to a seasonally adjusted annual rate of 5.66 million, the National Association of Realtors said yesterday.

Analysts who had expected sales to rise expressed concern that the real-estate market could tumble once the benefit of the federal tax incentives is gone entirely, starting next month.

The report is "a worrisome sign for what will occur in July and thereafter when the effect of the tax credit is behind us," said Joshua Shapiro, chief U.S. economist at MFR Inc., an economic consulting firm in New York.

Still, most economists don't expect the housing market to be weak enough to pull the economy back into recession. They anticipate that home sales will dip over the summer, then start growing by fall as the 9.7 percent unemployment rate begins to decline.

Existing home sales have climbed 25 percent from the 4.5 million annual rate they hit in January 2009 -- the lowest level of the recession.

But they're still down 22 percent from the peak rate of 7.25 million in September2005

The report counts home sales once a deal closes. So federal tax credits of up to $8,000 for first-time buyers and up to $6,500 for existing homeowners helped prop up sales in May.

The deadline to get a signed sales contract and qualify was April 30.

Buyers must have had to close their purchases by June 30.

The tax credits were expected to lift sales in May and June. Lawrence Yun, the National Association of Realtors' chief economist, said delays in the mortgage-lending process put about 180,000 potential buyers in limbo.

They are unlikely to qualify by the June 30 deadline. The trade group is pushing Congress to extend the deadline for closing a sale until Sept. 30.

Real-estate agents report a decline in foot traffic, meaning sales could worsen in the coming months.

"The urgency just isn't there," said Pat Lashinksky, CEO of ZipRealty Inc., which has agents in 22 states.

Floyd Scott, broker-owner of Century 21 Arizona-Foothills in Phoenix, said his office had about 25 percent fewer signed contracts to buy homes in May than it did a month earlier.

"The tax credit stopped and boy, I'll tell you, it was like, 'Wait a minute. Is the phone still working?"' Scott said.

Another troubling sign is the number of foreclosures and short sales. Short sales occur when lenders let borrowers sell a home for less than they owe on their mortgage.

~

Also See ~

Virginia Beach Family Takes Action As They Face Foreclosure.

~

The Cardinal Crisis

Americans Denied President Obama's Mortgage Modifications?

By Shahien Nasiripour

Huffington Post

June 29, 2010 -- Potentially "thousands" of troubled homeowners were denied opportunities to lower their monthly mortgage payments under the Obama administration's signature foreclosure-prevention plan due to servicer errors and inadequate oversight by the Treasury Department, a government audit has found.

Mortgage servicers failed to comply with basic guidelines, used different criteria to evaluate borrowers, recorded error rates up to six times their established thresholds, and couldn't provide evidence that potentially eligible homeowners had been solicited for the administration's

Home Affordable Modification Program, also known as HAMP.

The errors are partly due to Treasury's failure to issue specific guidelines for servicers to follow, and the administration's lack of quality-control standards.

Because servicers aren't required to adhere to the same set of standards, there's a risk that firms aren't identifying practices "that may lead to inequitable treatment of borrowers or harm taxpayers through greater potential for fraud or waste," according to a Thursday report by the Government Accountability Office.

But even if servicers were fraudulently modifying loans or improperly denying modifications to distressed homeowners, Treasury "has yet to establish specific consequences or penalties for noncompliance," the GAO notes.

The department has yet to fine any servicers for noncompliance, according to the report.

Already, "Treasury specifically allows some differences in how servicers evaluate borrowers... that could result in inconsistent outcomes for borrowers," the report found.

The end result could be the "inequitable treatment" of struggling homeowners who were looking to an administration for help during the worst economic downturn since the Great Depression.

HAMP is the centerpiece of the administration's $75 billion effort to stem the rising tide of foreclosures.

"I find it saddening and frustrating that none of these problems, which we among other people identified to Treasury over a year ago, have been meaningfully addressed," said Diane E. Thompson, a lawyer with the National Consumer Law Center.

"And as a result, we lost a major opportunity to stem the foreclosure crisis."

Last Thursday, the House Oversight and Government Reform Committee held a hearing to examine "the overall effectiveness of processes put in place by loan servicers as they implement HAMP and any other loan modification programs that help homeowners avoid foreclosures," according to the panel's announcement.

Not a single question was asked about the GAO's troubling findings, according to a transcript of the hearing.

The Treasury Department declined to comment, referring instead to its June 14 letter to GAO.

In its letter, Treasury said it had begun to address many of the shortcomings identified by the watchdog.

For example, Treasury has created a compliance committee to review results and ensure consistent treatment. Also, the agency has carried out on-site reviews of servicers' performance.

But perhaps most important of all, "we believe the GAO did not sufficiently take into account the scope and complexity of the challenges Treasury faced when it developed and implemented a modification initiative, the scale of which has never been previously attempted," Treasury Assistant Secretary for Financial Stability Herbert M. Allison, Jr. wrote.

Treasury data through May show that homeowners in HAMP saw their median monthly payment drop by about 41 percent, meaning that half the homeowners saw a bigger drop than 41 percent while half experienced a smaller decrease.

About 340,000 homeowners have received permanent relief.

More than 16 months after President Barack Obama told a crowd in Mesa, Ariz., of his plan to help up to 4 million homeowners avoid foreclosure through restructured mortgages, nearly 436,000 homeowners have been

kicked out of HAMP.

Put another way, 28 percent

more homeowners have been bounced from the program than are actively enjoying permanent lower monthly payments.

Servicers largely pin the blame on homeowners, who either fail to provide documents required to modify their mortgages, miss monthly payments or lie about their situation, like their income.

Treasury has echoed that complaint, but it's also pointed its finger at servicers who were slow to gear up for perhaps the biggest effort ever to modify home mortgages and lower borrowers' monthly payments, and thus at times proved inept to handle the volume.

The GAO's report, however, raises fresh questions about the effectiveness of a government program that repeatedly promised to help millions of distressed borrowers keep their homes, and its overseers entrusted with that responsibility.

Among the problem areas GAO identified in its report:

- Half of the 10 servicers GAO interviewed experienced a 20-percent error rate for calculating borrower income when it came to processing loan modifications, when the servicers' "own established error thresholds" were "often set at 3 to 5 percent."

-

- GAO noted that "without accurate income calculations, similarly situated borrowers... may be inappropriately deemed eligible or ineligible" for HAMP modifications.

-

- Four of the 10 servicers properly test their results to ensure compliance.

-

- Treasury's compliance unit identified four servicers that "could not always provide evidence that borrowers who were potentially eligible for HAMP had been solicited," as is required

-

- Some servicers erroneously charged borrowers "fees prohibited by HAMP guidelines" or failed to reduce borrowers' monthly payments to 31 percent or less of their gross monthly income, a HAMP requirement.

-

- At least one servicer's review of denied HAMP modifications focuses on whether borrowers were sent denial letters, rather than actually checking to see if homeowners were "appropriately" denied HAMP modifications.

-

- Treasury's lack of clear consequences "risks inconsistent treatment of servicer noncompliance and lacks transparency with respect to the severity of the steps it will take for specific types of noncompliance."

-

- Seven of the 10 servicers it contacted used different sets of criteria for determining "imminent default."

"While Treasury's goal is to create uniform, clear, and consistent guidance for loan modifications across the servicing industry, as we noted in March 2010, Treasury has not provided specific guidance on how to determine whether borrowers are in imminent danger of default," the GAO found.

"As also noted in SIGTARP's March 2010 report on HAMP, this lack of consistent and clear standards could mean that servicers are inconsistently applying criteria in this area and thereby inequitably treating borrowers across the program."

But "of concern," GAO noted, was that Treasury's compliance unit found that "15 of the largest 20 participating servicers did not comply with various aspects of the program guidelines" when it came to calculating whether borrowers were eligible for HAMP mods.

The calculation, which requires using things like borrower income, the homeowner's equity in their home, and other inputs to determine eligibility, is called the "net present value" test.

In short, if the calculation shows that the owner of the loan -- which includes investors -- would get more money from a modified mortgage than a foreclosure, then the borrower qualifies for a HAMP modification.

This complicated computer program has been guarded with relative secrecy by Treasury.

Broad outlines describing the test have been publicly released, but specifics remain undisclosed.

Because of errors in running these tests -- and Treasury's "lack of specific guidelines" in ensuring servicers grade themselves in a consistent manner -- the number of borrowers who were denied HAMP modifications "could range from a handful to thousands, depending on the size of the servicer and the extent of the error," GAO reports, citing the Treasury Department.

Treasury is making servicers reach out to those homeowners.

"None of these problems are new," Thompson said. "There is no oversight and no accountability for this program.

"There are thousands of people, maybe more than a million, who have lost their homes."

"It's too late for them."

For more, see the GAO's report on this matter here.

~

Why am I not surprised at the above report?

It is obvious that the Saturn-Uranus opposition, now nearing its fifth, and gratefully, last exact opposition to one another by July 26, 2010, has allowed unreliable people to make decisions that are not only in serious error, but so far from the mark as to be incredulous.

These historic and challenging times feature great change, and the kinds of changes we witness are usually sudden, deep, and very hard to take, considering the power of the cardinal transits rotating worldwide; along with the various levels of outright incompetence and stupidity obviously rampant within systems fleeced from within by a corrupted generation that loudly stated it would "never sell out."

Looks "sold out" to me.

I have advised people to do the best they can in preparing themselves for these great changes spurred on by the transpersonal inclinations of the outer planets, for the changes will be long-lasting into the 2010s.

Consider this input:

By David Moon of the Lunar Report

Handling Personal Change: Painful Or Grateful?

July 5, 2010 -- "Last Thursday I sat and had a beer with a couple of old friends. In a place that has been pretty important to the old friends and me for decades.

That place is going away soon. Not the friends. Just the place. And not the memories. We’ll have those forever.

But the place and the headaches and that tired old comfortable part of us will move on and into the early stages of someone else’s memory.

“I can’t stand change,” is what my Mom says quite often. The woman is 90 years old. You’d think she would be accustomed to change by now. But she’s not. Never will be.

Change is tough. Even if it’s good change. Like a child leaving home to begin his or her new life. To go to school. To be married. Like buying a brand new Mercedes for an older person who only drove Buicks for 50 years.

Like turning a tired old A&P grocery store into a Food Lion with automated check out, wider isles and no coffee bean grinder. We just tend to prefer the comfort of what has always been. No matter how painful that comfort becomes.

I owned a house a few years ago. Well, I was paying for a house that was meant to be owned by me one day. The ex-wife and I bought it in 1984. Just months before our child was born. It was the only home my son ever knew.

It wasn’t an easy thing to do. Actually, the house owned me. You know. When you are buying a house, you pay more than just the mortgage, second, third and fourth ones.

You also are obligated to maintain the cash cow. Well. If I couldn’t even pay the mortgage, how on earth could I afford a new heat pump? Or paint? Or plumbing? Or light bulbs for that matter?

After the wife and I split, I tried to hang onto that home. It was so hard. Shortly after my son left for college, the banks and lawyers came calling. The note was due. I could hang on no longer.

Losing your home to foreclosure is not easy. It’s embarrassing. It’s failure. You know? You had the “American Dream,” and you just sort of let it drift away.

The strong man in your child’s life, the man you always envisioned yourself to be, just couldn’t cut it. That was the hardest part. My idea of what was on my son’s mind. My perception of his perception of his Dad. That was shattered.

Losing that house was one of the hardest changes for me to accept. I guess it’s because I had a certain amount of control over that whole thing. And I let my family down.

But losing that house was also the best change that ever happened to me. Shortly after I gathered my belongings and exiled myself to an 80 year old rental, I was asked my someone, “So why did you move?”

At first, I lowered my head just a bit, wondering how I could tap-dance my way into an adequate answer. Then something came over me.

In a split second, I understood completely that I tried my damnedest to hang onto that house as long as my son was at home. I did that. I did good.

I quickly and proudly lifted my head, looked the other person squarely in the eye and said, “I lost the house to foreclosure.” I smiled.

The other person was a bit taken aback. That was understandable. But that was the end of the discussion about the house and my move.

I have never felt as free as I did after saying what I did to my friend.

Yes, I screwed up by losing that place. But I also succeeded in providing a home for my son until he left home for his own future.

I am human. Like all humans, I make mistakes. That was the first major mistake I can remember ever boldly and totally honestly admitting to anyone. And that honesty has opened up so many wonderful doors ever since.

People trust me these days in ways I never knew possible before that foreclosure admission. More important than that? I trust myself.

To be honest. And to do so with head held high. I guess I finally understand Popeye - “I ams what I ams.” Or something...

It was a change. A very difficult one. But the reward was freedom. And honesty. And dignity. And so many opportunities since.

So. To my friends who are undergoing some pretty harsh life changes right now – embrace them.

Good riddance to all the headaches. Be proud of the things we have accomplished. And welcome the new opportunities.

When we are all settled into our new lives, I will bring more beer. And we will hold our heads up and aimed toward the future. And not down, looking at the worn old floors of days gone by."

~

The effects on people from the current Bank Crisis, the foreclosures, the separation of families, and the demise of communities will be profound in the years to come.

I have warned the Baby Boomer generation of the negative impacts of their decisions during the 18 years as the establishment, and continue to state that global transits show there is a serious reckoning on the way for this generation that they have not considered.

I also continue to warn policymakers that if they think that there are no dire consequences to their failures, that they could not be more wrong.

In the years ahead, as the Cardinal Crisis transits mature into the early-to-mid-2010s, there will be increasingly violent protests, and direct actions taken by the populace with one goal in mind:

To make those responsible for the losses of millions of people to pay, in full, for their greed, corruption, and dirty deeds that has changed entire landscapes of whole neighborhoods, communities, counties, states, and nations.

The effects on people will be considerable, which is why I continue to urge anyone who will listen to take the time to redirect their energies to adapt to these historic changes, which will dominate the lives of many people during the decade of the 2010s.

The Cardinal Crisis

Meeting The Long-Term Unemployed

By Mitchell Hartman, Marketplace

CHICAGO, ILLINOIS --"The first thing I did when I got the assignment to go to Chicago for a week of reporting on unemployment, was to call one of my oldest friends in the world.

When we were little, we lived in the same crummy apartment building in East Rogers Park on Chicago's North Side.

She's all grown up now, owns a nice big apartment in Evanston, and has an executive-level job at one of Chicago's premier academic hospitals.

I asked her if she knew anyone who was unemployed. "Not really," she said, after a long pause. "Not that I can think of, anyway."

The next day, she called me back. She'd thought of some. Quite a few, actually. Two people in her building--both middle-aged professionals, out of work for months and months already.

And then some parents at her kid's school. Her colleagues at work knew a bunch as well.

The long-term unemployed were coming out of the woodwork.

And Illinois certainly has its share of them, with the 8th-highest unemployment in the nation. At 11.2 percent, it's worse even than my struggling home state of Oregon.

Long-term Unemployment A National Trend?

But really, we could have gone anywhere to find high, persistent unemployment. As one economist told me, long-term unemployment is now off the charts.

A man scans employment notices on the wall at the New York State Department of Labor employment center in the Brooklyn, New York.

Credit: Spencer Platt/Getty Images

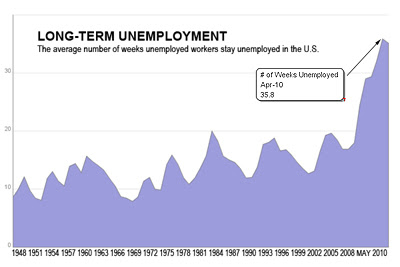

Nearly half of unemployed people (46 percent) have been job-hunting for 27 weeks or more -- the highest percentage since the Bureau of Labor Statistics began keeping track in 1948.

The typical job hunt is now 35 weeks -- that's more than eight months.

In 2010, the United States reached a record for the highest average of number of weeks unemployed workers remained unemployed.

Click on Graphic To Enlarge

Again, a record. There are five job-seekers for every available job. Before the recession it was less than two-to-one.

And unemployment--especially when it lasts a while -- hits like a brick.

I've seen this in the parents at my kids' school. We know high-tech workers, architects, urban planners, nurses, teachers, technical writers -- all out of work for a year or more.

In some families, both parents have lost jobs. I found the same pain -- and shame -- in the voices of middle-class workers I met in Chicago who have lost jobs and had no luck so far finding new ones.

One night around 2 a.m. I stumbled on a weird scene. As rain pelted down, spotlights shown on workers in hard hats hanging from struts a hundred feet in the air.

They were upgrading a section of railroad bridge over the Chicago River. It seemed like hard, harsh work, and the hours were lousy.

Several men came over and said it was pretty good, actually: the first construction jobs -- the first jobs -- they'd seen in over a year.

The youngest job-seekers are really taking it on the chin in this so-called "recovery." I met a dozen graduates at Loyola University Chicago who are frankly freaked out at their job prospects.

Most don't have anything you'd call the on-ramp to a career lined up for the summer or fall. The lucky ones are working retail or behind the bar. At least they won't have to sponge off their parents.

Or they can't. One told me whatever the job market holds, she's "off the parental payroll" now.

Unemployment Dreams & Versus?

I hit a rich vein when I asked them about their dreams -- nightmares, really. One told me she dreamed she was a barista -- but the espresso machine was in Brazil. And she didn't speak Portuguese.

People were yelling orders at her, and she couldn't understand a word.

At Columbia College in downtown Chicago, I found a scrappier scene -- poetry students poetry -- slamming at the school's start-of-summer arts festival.

I asked them to pen me some spontaneous verse about unemployment. Again, you can listen to what they came up with by clicking on the audio links above.

The New Frugality?

I got a tour of one 48-year-old woman's rental apartment in the suburbs -- a "frugality" tour, she called it. She showed me the fancy Vita-Mix juicer she bought -- at Goodwill.

The cashmere sweaters she got at a thrift store. The TV that doesn't have cable anymore.

Earlier in her life she might have been ashamed at showing this new lifestyle to a stranger. But now she takes pride in it.

After decades of paying her own way, putting herself through college, working hard and never being idle, she's been unemployed for more than a year. She's taken the opportunity to go back to school and get a Master's in counseling.

She now volunteers to help women at a domestic violence shelter prepare resumes and go out to look for work. But she hasn't found any herself. And her unemployment's about to run out.

I dropped in on a roomful of part-time sessional academics sipping tea and eating pastries at the Russian Tea Time restaurant downtown, as they were tutored by union organizers on the fine points of applying for unemployment benefits.

Many of them have been offered fewer classes to teach -- and no summer work at all -- because schools are cutting back. All have Master's degrees or Ph.D.s.

One told me she left a career in the insurance industry to teach writing because she thought an academic job would pay about the same and enrich her life more.

But there aren't many tenure-track jobs, and there's a lot of competition.

A Hard Bounce Back?

There are those who say that if unemployed people really wanted to work badly enough, they'd find something -- minimum-wage fast food or mowing lawns or odd jobs under the table.

Some economists argue that the higher the unemployment benefits, and the more they're extended, the less likely people are to feel the pain of true destitution and take whatever they can get.

And it's true, people do hold out for something better when they've still got an unemployment check coming -- even if it's not nearly what they used to make and doesn't pay the bills.

But I wonder -- should people take whatever they can get; settle for work that doesn't pay a living wage; doesn't interest, or stimulate, or inspire them in the least?

That doesn't utilize their education, or skills they've built up over years or decades? And that won't likely lead them anywhere but to more low-wage monotonous work down the road?

Many of the long-term unemployed people I've met in my reporting are still holding out, still hoping for something better.

Or at least for something halfway decent. They still seem to believe that's what work is all about. But they're running out of time."

~

The Cardinal Crisis

British Graduates Warned Of Record 70 Applicants For Every One Job

Class of 2010 Faces Bleak Economic Times: Waiting to graduate is increasingly being followed by long waits in finding work as competition for jobs intensifies like never before in the United Kingdom.

Credit: Matthew Power/Rex Features

By Jeevan Vasager

The Guardian

July 6, 2010 -- LONDON, ENGLAND -- Graduates are facing the most intense scramble in a decade to get a job this summer, as a poll of employers reveals the number of applications for each vacancy has surged to nearly 70 while the number of available positions is predicted to fall by nearly 7%.

The class of 2010 have been told to consider flipping burgers or stacking shelves when they leave university as leading firms in investment banking, law and IT are due to cut graduate jobs this year.

Competition in the jobs market is fiercer now than for the first "post-crunch" generation of students, last year, when there were 48 applications for each vacancy.

The number of applicants chasing each job is so high that nearly 78% of employers are insisting on a 2.1 degree, rendering a 2.2 marginal and effectively ruling out any graduates with a third, according to the survey published tomorrow.

The Association of Graduate Recruiters polled over 200 firms including Cadbury, Marks & Spencer, JP Morgan and Vodafone and found the number of applications per vacancy had risen to 68.8 this year, the highest figure recorded.

In the most hotly contested sector – makers of fast-moving consumer goods such as food, confectionery and cosmetics – there were 205 applications for each job.

Carl Gilleard, the association's chief executive, said graduates needed to be more flexible in their career choices.

"They need both short-term and long-term career goals because you're graduating in a very tough climate. It doesn't mean you should be put off applying for the profession of your choice.

"Any employment is better than no employment [even] if it's about flipping burgers or stacking shelves rather than being sat at home feeling sorry for yourself and vegetating.

There are lots of other skills required and valued, like people skills: you could be on a counter in a store. It's all about building up your skills base. The big fear is that some people just drop off the bottom of the scale – because confidence goes very rapidly."

Gilleard warned that employers were raising the bar on degrees, and graduates with a 2.2 or worse faced being filtered out by automated applications.

"There are dangers in that. You can miss out on some very good candidates."

He said it was too early to say whether this trend would lead to graduates with a 2.2 being excluded from the job market altogether.

In 2008, when the economy was buoyant, just 57% of employers insisted on a 2.1 or higher. Last year that rose to 60%.

"We need to wait for 2011 to see if this is a trend," he said.

Graduate salaries are frozen at an average of £25,000, the first time in the survey's history that starting salaries have remained stagnant for two consecutive years.

But there is some positive news; the survey noted a revival in banking, the insurance sector and accountancy where vacancies were predicted to rise this year.

Apprenticeships, which are likely to expand under the coalition government, might provide an alternative career path for some students, the survey noted.

Gilleard acknowledged there was snobbery about apprenticeships, but said the children of the middle classes should not assume they had to get a degree to succeed.

"I think many middle class parents are actually questioning, is this [a degree] the right route that my son or daughter should follow.

"Too many young people go [to university] because it's expected of them, and they don't think it through from a personal perspective – what will it be like, apart from having a good time."

As applications for university places continue to soar, the government has urged universities to publish statements revealing the help they offer to get their students ready for work.

Responding to the survey, the minister for universities, David Willetts, said: "The job market remains challenging for new graduates, as it does for others.

"But a degree is still a good investment in the long term, and graduates have a key role to play in helping Britain out of the recession.

We are committed to making it easier for current graduates to find work. That is why I have just asked all universities to provide statements on employability for their students."

The president of the National Union of Students, Aaron Porter, urged the government to invest in creating jobs and training:

"We are concerned that the savage cuts to the public sector will create further unemployment, and will make the lives of graduates tougher in an already difficult jobs market."

For the fourth year in a row, demand for university places has hit a record high.

At the end of May, there were over 640,000 applications for places this autumn – an increase of nearly 14% on last year.

As universities face an increased challenge in selecting the best candidates, there is some skepticism about the new A* grade, being awarded for the first time this summer in an attempt to distinguish the cream of the crop.

Fewer than a third of university admissions officers believe the A* grade would be crucial in selecting the most able students, according to a separate survey published today.

While over half of the 40 admissions officers surveyed believed grade inflation made it harder to pick the best candidates, fewer than a third thought the A* was "essential".

The survey was commissioned by a network of international schools which favor a rival qualification, the international baccalaureate.

~

The Cardinal CrisisPunishing the Jobless?

By Paul Krugman, New York Times

Paul Krugman

There was a time when everyone took it for granted that unemployment insurance, which normally terminates after 26 weeks, would be extended in times of persistent joblessness.

It was, most people agreed, the decent thing to do.

But that was then.

Today, American workers face the worst job market since the Great Depression, with five job seekers for every job opening, with the average spell of unemployment now at 35 weeks.

Yet the Senate went home for the holiday weekend without extending benefits.

How was that possible?

The answer is that we’re facing a coalition of the heartless, the clueless and the confused.

Nothing can be done about the first group, and probably not much about the second. But maybe it’s possible to clear up some of the confusion.

By the heartless, I mean Republicans who have made the cynical calculation that blocking anything President Obama tries to do — including, or perhaps especially, anything that might alleviate the nation’s economic pain — improves their chances in the midterm elections.

Don’t pretend to be shocked: you know they’re out there, and make up a large share of the G.O.P. caucus.

By the clueless I mean people like Sharron Angle, the Republican candidate for senator from Nevada, who has repeatedly insisted that the unemployed are deliberately choosing to stay jobless, so that they can keep collecting benefits.

A sample remark: “You can make more money on unemployment than you can going down and getting one of those jobs that is an honest job but it doesn’t pay as much. We’ve put in so much entitlement into our government that we really have spoiled our citizenry.”

Now, I don’t have the impression that unemployed Americans are spoiled; desperate seems more like it.

One doubts, however, that any amount of evidence could change Ms. Angle’s view of the world — and there are, unfortunately, a lot of people in our political class just like her.

But there are also, one hopes, at least a few political players who are honestly misinformed about what unemployment benefits do — who believe, for example, that Senator Jon Kyl, Republican of Arizona, was making sense when he declared that extending benefits would make unemployment worse, because “continuing to pay people unemployment compensation is a disincentive for them to seek new work.”

So let’s talk about why that belief is dead wrong.

Do unemployment benefits reduce the incentive to seek work?

Yes: workers receiving unemployment benefits aren’t quite as desperate as workers without benefits, and are likely to be slightly more choosy about accepting new jobs.

The operative word here is “slightly”: recent economic research suggests that the effect of unemployment benefits on worker behavior is much weaker than was previously believed.

Still, it’s a real effect when the economy is doing well.

But it’s an effect that is completely irrelevant to our current situation.

When the economy is booming, and lack of sufficient willing workers is limiting growth, generous unemployment benefits may keep employment lower than it would have been otherwise.

But as you may have noticed, right now the economy isn’t booming — again, there are five unemployed workers for every job opening.

Cutting off benefits to the unemployed will make them even more desperate for work — but they can’t take jobs that aren’t there.

Wait: there’s more.

One main reason there aren’t enough jobs right now is weak consumer demand. Helping the unemployed, by putting money in the pockets of people who badly need it, helps support consumer spending.

That’s why the Congressional Budget Office rates aid to the unemployed as a highly cost-effective form of economic stimulus.

And unlike, say, large infrastructure projects, aid to the unemployed creates jobs quickly — while allowing that aid to lapse, which is what is happening right now, is a recipe for even weaker job growth, not in the distant future but over the next few months.

But won’t extending unemployment benefits worsen the budget deficit?

Yes, slightly — but as I and others have been arguing at length, penny-pinching in the midst of a severely depressed economy is no way to deal with our long-run budget problems.

And penny-pinching at the expense of the unemployed is cruel as well as misguided.

So, is there any chance that these arguments will get through?

Not, I fear, to Republicans: “It is difficult to get a man to understand something,” said Upton Sinclair, “when his salary” — or, in this case, his hope of retaking Congress — “depends upon his not understanding it.”

But there are also centrist Democrats who have bought into the arguments against helping the unemployed. It’s up to them to step back, realize that they have been misled — and do the right thing by passing extended benefits.

~

The revelations of hedge fund and financial fraud and corruption will continue under the Cardinal Crisis transits.

Consider this report of one event concerning a German hedge fund player:

The Cardinal Crisis

German Hedge Fund Player Found Dead in Spain? Spanish police stand over a small cove in Majorca, Spain, as authorities recover the body of hedge fund director Dieter Frerichs, a suspect of an international probe of the German hedge fund firm K1 Group. Frerichs, age 72, was said to have jumped into the water, fired one shot into the air, and then allegedly shot himself in the head while being arrested by police on July 5, 2010.

Hedge Fund Investor Dies in Spain

By David Jolly & Raphael Minder

New York Times

July 5, 2010 -- A hedge fund investor wanted by German prosecutors in connection with a bank fraud investigation has died in Majorca, Spain, apparently from a suicide.

The suspect, Dieter Frerichs, 72, died of a gunshot wound on Saturday after police officers went to his home in Palma to serve a warrant for extradition to Germany, the Spanish police said Monday.

Mr. Frerichs was the director of two funds, K1 Invest and K1 Global, controlled by Helmut Kiener, the founder of K1 Group.

Helmut Kiener

Mr. Kiener has been in custody in Würzburg, Germany, since October 2009 on suspicion of operating a pyramid scheme, defrauding thousands of private investors and banks including JPMorgan Chase, Barclays and BNP Paribas of more than €300 million, or $375 million.

The F.B.I. is also investigating the group, as are the authorities in the British Virgin Islands, Liechtenstein and Switzerland.

The two highly leveraged funds had a combined €421 million of liabilities when Grant Thornton, the international accounting firm, was retained in November to liquidate them.

The authorities say the prospects for recovering most of those funds are poor.

According to a police spokeswoman, three officers went to arrest Mr. Frerichs at his home on the island at 11:30 a.m. on Saturday and found him sunbathing near his home on rocks overlooking the sea.

When the officers identified themselves, they said, Mr. Frerichs took a gun from a bag that was lying beside him and leapt into the water.

Mr. Frerichs fired two shots, the spokeswoman said. The first, presumably to test the gun, they said, was fired in the air; with the second, he shot himself in the head.

Mr. Frerichs was picked up by a rescue boat and taken to the Son Dureta Palma hospital. He died not long after arrival.

The case has sent shock waves through Spain, where Mr. Frerichs’s stepdaughter, Fiona Ferrer Leoni, initially told the news media that the police had shot Mr. Frerichs.

She also questioned the police account of him sunbathing with a gun.

Ms. Ferrer, a prominent television personality and model, is married to Jaime Polanco, a Spanish tycoon whose family controls Promotora de Informaciones, or Prisa, the media group, whose assets include El País, the newspaper.

She also told Spanish the news media that Mr. Frerichs had been sought only for his relationship to K1 Group officials and that he was innocent of any fraud. Ms. Ferrer could not be reached for comment on Monday.

The police spokeswoman, who cannot be identified because of department policy, categorically denied that police officers had fired at Mr. Frerichs.

She said his weapon had been retrieved by divers and would be used, along with an autopsy, to determine the exact circumstances of his death.

“It is not normal to be sunbathing with a bag that has a gun,” the spokeswoman said. “But that’s what he did.”

Dietrich Güder, the state prosecutor in Würzburg, declined to comment beyond confirming that he had been apprised of the situation by the Spanish police.

Lutz Libbertz, a lawyer in Munich for Mr. Kiener, argued in a November court filing that Mr. Kiener could “at the most be accused of making bad investment decisions, but not of actions constituting breach of trust.”

Mr. Libbertz declined to comment on Monday, saying through an associate that “he had nothing to add to what’s already been said.”

Mr. Kiener, a former psychologist, was suspected of having lured investors with his claims of consistent and stable returns.

Mr. Kiener touted the power of his “K1 Fund Allocation System,” and is suspected of having benefited from banks’ lax lending oversight during the credit boom.

He claimed that his investments had returned more than 700 percent between 1996 and the end of 2008.

The case has been embarrassing for Germany, as BaFin, the market regulator, had several times sought to stop Mr. Kiener’s activities over significant legal infractions but had its enforcement actions overturned on appeal.

~

Consider this:

The Cardinal Crisis

The 'Lying Liars' of Goldman Sachs?

Goldman Sachs, still reeling from a bad series of appearances, in front of Congressional hearings, still has not explained its role in the global economic crisis:

~ Bloomberg reported July 1, 2010 ~

Goldman Sachs' Role In Crisis At Stake?

By Christine Harper

July 2, 2010 -- Goldman Sachs Group Inc. executives sought to defend the firm’s pricing of illiquid mortgage derivatives during two days of hearings as investigators questioned whether the firm accelerated the financial crisis.

Gary Cohn, Goldman Sachs’s president and chief operating officer, and Chief Financial Officer David Viniar argued that the firm’s prices in 2007 and 2008 reflected what it saw in the market.

Financial Crisis Inquiry Commission members questioned whether the investment bank deliberately discounted prices to push markets lower because it had bet on a decline in the value of subprime mortgage-backed debt.

“You guys are net short and you’re driving down prices, are you creating a self-fulfilling prophecy?” Philip N. Angelides, chairman of the FCIC, asked Viniar during yesterday’s hearing.

“Were you in fact pushing the market down?”

Viniar, 54, replied that “we never instruct people to mark things down. We mark where the market is.”

The dispute is at the heart of whether Goldman Sachs had a role in the near-bankruptcy of American International Group Inc. or was a careful risk manager whose focus on marking assets to fair value helped the securities firm prepare for the credit contraction earlier than rivals.

Goldman Sachs, whose record 2007 profit was helped by bets against securities backed by subprime mortgages, was one of the biggest buyers of AIG’s insurance covering such debt and increased demands for collateral from AIG as prices fell.

‘Smoking Gun?’

Goldman Sachs might have the power to drive down prices in an illiquid market like the one that existed in mid-2007, said David Killian, a fixed-income portfolio manager at Sterling Asset Management LLC.

Still, he said there’s no evidence that the firm intentionally pushed down marks for its own benefit.

“Unless someone’s going to come up with some smoking gun and e-mails that show they did conspire to do that, I think that would be incredibly difficult to prove because managing risk is in fact what they do for a living,” said Killian, whose King of Prussia, Pennsylvania-based firm owns Goldman Sachs stock and bonds.

“If that’s proven, that’s bad news.”

The Securities and Exchange Commission sued the company that same month, claiming it sold a collateralized debt obligation without disclosing that a hedge fund helped pick underlying securities and bet against the vehicles.

Goldman Sachs has denied wrongdoing.