The Cardinal Crisis

Credit: Ahmed al-Husseini/AP

Accidents, Floods & Senseless Violence

Plus,

Also,

Plus,

Θεόδωρος

The powerful Cardinal positions of the planets relative to the Earth continued their powerful inclinations in the month of August, affecting tens of millions of people worldwide.

From great floods in Pakistan, India and China to a series of violence and tragic events throughout the world, it is difficult for many to understand what has been happening.

These are the inclinations of the planets relative to Earth, and their motions continues to show how our world is undergoing yet another major transition by passage of global transits, or, what we also call time.

In this edition of Global Astrology, we examine present trends, and we look to the future implications of the some of the most pressing questions in these times as we enter the second decade of the 21st century.

The Cardinal Crisis

World transits continue inclinations which have led to accidents from dangerous and unfavorable travel, weather extremes, and outbreaks of senseless violence fueled by anger, ignorance, haste and impulse.

August is the sixth month of the year in the mundane calendar. The world is now entering the second half of the astrological year of 2010.

I have been forecasting on the increased delays and dangers of travel on road, by air, and over water.

We have witnessed the climate impacts on populations, as well as the unfavorable inclinations which have led to events affecting millions of people through weather, accidents, and senseless violence.

Here are the most recent events to take place under the cardinal world transits:

Pakistan's Great Floods: Residents Brace For Second Wave Of Problems

Scores Missing In Mudslides in China

Pakistan Warns Of More Heavy Rains, U.N. Says 800,000 People Cut Off By Floods

53 Dead In Attacks On Iraqi Security Forces

American Iraq-war Vet Kills Entire Family in Wisconsin

Marines Find 72 Bodies In Mexico

Parents Demand Justice For Finn Killed In Mexico

Tourist Hostage Murders & Bus Blunders Leave Black Mark On Philippine Police

Bodies, Survivors of Manila Hijack Drama Head Home To Hong Kong

Passenger Jet Crashes in China

Train Hits School Bus in South Africa, 9 children killed

China's Massive Traffic Jam

~

Prepare For Public Illnesses Due To World Transits

By Theodore White, mundane Astrolog.S

Global Astrology

I've reviewed the transits of 2010-2012 for the northern hemisphere. From the transits I've interpreted it is my assessment the upcoming winter 2011 season will be wetter and colder than normal.

Illness will run high this winter. Given the climate conditions worldwide, along with the heavy rains, and floods, transits surely point to a rise in public health warnings ahead.

My mundane calculations advise people to take precaution against the flu; especially over the months of late February, March and April 2011.

My transit readings show me that generalized infections of the respiratory system will be the main problem during the winter season. It will be a rough winter for sickness among populations. It is wise to take precautions at home, and in public.

I advise parents to be on the lookout for Pertussis, or Whooping Cough, among children as an outbreak is forecasted for the autumn and winter seasons from the Pacific Northwest to the Upper Midwestern regions of the U.S.

In the first half of 2010 for example, state health officials in California confirmed that there were 3,076 cases pertussis in August. This is a rate that is seven times higher than in 2009. So far, eight infants have died.

We can expect whooping cough cases to spread and expand in the United States through to 2012-2013, according to my calculations. Look for it in the news headlines.

Whooping cough is highly contagious. It is deadly for infants, toddlers, young children, senior citizens and for those with compromised immune systems.

A preschool-age child with Pertussis (whooping cough.)

It can be passed on by adults to children. Pertussis is highly communicable; can last for weeks and in children can cause spasms with bouts of severe coughing, or a "whooping," sound that signifies what is basically a phlegmatic disease.

This phlegmatic disease stresses the respiratory system. Mundane astrologers have noted the incubation periods of pertussis generally follows the phases of the Moon - from seven to 10 days.

The first signs of pertussis, or whooping cough, is a runny nose, sneezing, accompanied by a low-grade fever. The initial coughs are similar to what you'd expect with signs of a common cold coming on.

However, pertussis is usually not diagnosed until after the cough gradually becomes severe.

Children and the elderly can experience difficulty breathing. The uncontrolled bouts of coughing have a familiar high-pitched "whooping" sound as the patient tries to breath.

Photograph of a child afflicted with whooping cough paroxysms. Coughing with the characteristic ‘whoop’ sound.

Symptoms get worse as the Moon advances, for about two weeks, but can persist for several weeks before subsiding.

Whooping cough can be treated with antibiotics, but the common problem other than the persistent coughing, vomiting, and trouble breathing is being struck with a secondary bacterial infection. This is the cause of most deaths from pertussis.

click on graphic to enlarge

Look for vaccination programs offered by public health officials in your region, and be keen to make sure your family is protected by taking preventative measures.

The transits of fall 2010 and winter 2011 strongly highlight health matters, and illness. For most regions, the autumn 2010 ingress will be ruled by Mercury. The winter solstice ingress will be ruled by Saturn.

Be prepared by strengthening the immune system with proper diets, common sense and above all - hygiene. Pay close attention to impending signs of illnesses breaking out this fall and winter.

I am forecasting that a major Pertussis, or Whooping Cough outbreak will expand mainly through the Pacific Northwest and upper Midwestern regions of the U.S. between 2010 through to 2013.

Caution is strongly urged for parents to protect their children and public health officials are advised to prepare for a major outbreak of Whooping Cough.

~

In my previous forecasts on the return of La Nina during the second half of 2010 and into the first half of 2011, I expect the fall season to be also be foggier than normal, with sometimes dense and pervasive fogs in October, November and December throughout the northern hemisphere.

My warning for a colder-than-normal winter season for the Pacific west and northwest of the U.S. remains the same. Prepare for colder than normal temperatures not seen for years in this region.

The major theme of Winter 2011 will be bone-chilling cold air temperatures with wetter than normal conditions along with snow, and ice storms striking parts of the Pacific northwest.

The storms will continue through the 39th parallel and into Alberta, Canada, through upper parts of the Great Lakes, and into the northeastern United States and Canada this year. The Upper Plains states will experience wetter than normal winter conditions.

Expect the prime winter season to arrive later than normal this year for two-thirds of the U.S., and Europe, mainly taking place from February through April 2011.

The air is thick with dense fogs prior to the onset of winter. Jet stream fluctuations from the cooling of the Pacific Ocean and the onset of La Nina shows problems with the air, with climate conditions that are wetter and much colder than normal.

Return of La Nina: Colder sea temperatures in the equatorial Pacific Ocean

Winter 2011 is not a "dry cold," but a "wet cold winter," which can be among the worst kind of winter seasons in the northern hemisphere.

My astrometeorological assessment of astronomical transits shows Winter 2011 will be a Phlegmatic Winter.

The transits and the influences on the climate will mainly affect the respiratory system.

Astrologers will want to run sunrise cycle charts from February through early April. Note planetary positions rising in the late February, through March in tropical Pisces, signifying the health, but also the weather.

The shape of the cycle charts will be that of a train with planets rising in Aquarius and Pisces, ending with Jupiter's square to Pluto in tropical Capricorn.

The winter weather will be windy, wet, colder than normal, and damp. It features trouble breathing for those who fall ill to respiratory diseases.

Juno is retrograde in Virgo signifies the public health. This features nurses, medical professionals and public health officials who are sometimes overwhelmed with patients who are sick and require medical attention.

This continues as the Moon and Mars conjoin with Uranus, the Black Moon (Lilith) and the fixed star Scheat at 29-Pisces on April 2, 2011.

Chiron and Ceres are also conjoined in early Pisces with Venus within orb by the end of March 2011. This signifies many children will continue to recover at home during spring break next March and April.

It appears, from what I can see , some regions throughout the northern hemisphere may be forced to close schools because of these outbreaks due to transits and climate.

From the looks of these transits, the "spring break" of March/April 2011 looks more like "sick and recovering at home break."

These illnesses are generally based on a lack of proper diet and inattention to hygiene, especially in schools, and in public where contagion is more easily passed on among people.

The economic crisis and the heavy rains in regions has most likely led to many millions of people under the weather by the time winter has taken hold in the northern hemisphere.

The climate I forecasted is colder than normal, but the moist climate conditions spurred by Saturn's transit in Libra will give way to wide outbreaks of flu and related diseases, according to my calculations.

Under these particular astrological conditions, the illnesses can tend to be deadly should proper preparations not take place.

- Drink Cherry Juice During The Winter

- Eat More Beans & Rice

- Reduce soda drinking during winter

- Note Signs of Colds Earlier Than Normal

- Build strong immune system with Cod liver oil, and Colloidal Silver

- Wash Hands More frequently

- Look For Public Service Announcements of Vaccinations

- Use Mentholated Cough Drops When In Public

- Wear winter gloves when touching public surfaces

- Protect Feet This Autumn & Winter.

- Avoid using public bathrooms during autumn & winter

- Monitor signs of spreading sickness among Schoolchildren; especially whopping cough

- Watch for rises of mononucleosis

The color Orange is known to impart heat and helps to cure people suffering from colds and phlegmatic illnesses.

The color Green is cold by temperament, and helps to fortify the muscles and keeps the brain cool and strong. It helps in removing rheumatic and related disorders.

Blue or indigo is cool to the senses and can eliminate diseases that come from excessive bile in the body, and related illnesses.

The use of colors in recovery, along with proper medical attention, and healthy diets can go a long way in helping those sick to recover back to wellness.

However, prevention is the best cure.

Now, the reason for all this is because of the transits I've seen over the coming winter months. March and April 2011 is particularly acute with many people feeling under the weather, and sick from the spread of flu.

This flu appears to be of the type featuring full head & body aches, in a phlegmatic respiratory state also featuring a persistent cough.

By early March 2011 there are also cases of people with these symptoms, some with running diarrhea and lack of appetite.

The climate is the prime cause - it will be colder and wetter than normal.

At this time, there are lots of mothers taking care of children and spouses who seem to be having a hard time shaking off the flu during this coming winter. The problems can be headed off at the pass if one is busy with preventive actions in early fall.

It is best to accomplish most of this before October 7, 2010, by setting up a prevention plan, and notifying friends, neighbors and family to be on the lookout for sick people, especially for signs and cases of Whopping Cough, and any kind of respiratory problems.

One of the keys other than building up immune systems during the late summer into early autumn is to protect your feet and head in the weather and to wash hands.

Also adjust family diets as quickly as possible. Steer clear from pork, heavy meats, and reduce consumption of fast foods meals, and soda.

Focus on eating healthier foods in smaller sizes during the day. Also add cod liver oil and colloidal silver to your family's diet for full protection before the outbreaks of fall and winter.

Expect a busy winter season taking care of those who do become sick. Again, prevention is the best medicine of all.

~

The societal effects of the Bank Crisis, and credit crunch that continues worldwide will surely bring about more change than many populations have been prepared for, in fact, most people still are not handling the changes very well.

My analysis of the coming months of September 2010 through March 2011 indicates that this is a dark, and brooding six months that continues the theme of depression.

Here, we explore the nature of relationships as spikes in marriages and divorces are forecasted ahead.

Global Astrology

The Eighth House of Scorpio holds general rulership over Personal relationships within marriages and divorces, suicides, family finances, pension systems, public taxes, along with the general mortality rate, international agreements, privy councils, and economic relations with foreign nations.

Saturn also has function over state marriages or funerals where public expressions of either happiness or sorrow is exhibited nationally.

The area of relationships is strongly inclined with Saturn in Libra. From this vantage point, the astrologer is able to see how functional, or dysfunctional relationships in society will be over the years.

It is my assessment after detailed review of global transits that the dysfunctional behavior of people, especially those in the financial and economics sector, is now spreading out into society at large.

It has been coming for some time. There were voices back in the early days of the feminist movement of the early 1970s who warned families would also suffer dysfunction which, in the end, would lead to the collapse of the family unit.

This is now happening with the rise of divorces under the Baby Boomer generation, and the failure of today's women to find men who say they have been scared away from commitment and marriage.

Libra highlights personal relationships, and marriages. As Saturn is now in tropical Libra through October 2012, I expect divorces to rise; especially in western nations.

Consider this recent report:

Divorce rates have declined in Minnesota and nationwide over the past few years, primarily because people couldn't afford to separate.

But experts are seeing the numbers go up -- one Twin Cities divorce attorney is "swamped" -- as the economy struggles to recover.

Others whose financial situations haven't improved are also deciding to split up because they at least want emotional happiness.

Marlene Eskind Moses, president of the American Academy of Matrimonial Lawyers (AAML), said it's too soon for collective national numbers, but she is hearing from members seeing an increase because the current economy is "the new normal."

"With the recession, there was initial shock that paralyzed people. They were frozen, not wanting to make any more significant changes in their lives.

They weren't any happier than before, but too afraid to do anything about it. Now people are stabilizing, acclimating themselves to the new economic realities, and saying, 'Things may not change soon, but at least I can have a happy life on an emotional level.'"

Area divorce attorneys who have seen an uptick after a slack period include Michael Dittberner, who practices in Edina.

"People are either now able to move forward or just can't put it off any longer," he said, "They have issues related to their children or are trying to protect themselves financially."

Andrea Niemi, a Minneapolis attorney whose focus is on alternative dispute resolution, has seen a spike in early neutral evaluations, which are requested within about two months of a couple's divorce filing.

"I was twiddling my thumbs a year ago and now I'm swamped," she said.

The state's most populous county saw a noteworthy increase in the first four months of 2010.

Sadly, the rise in divorces reflect a sickness that has affected the lives of males and females over the last 30 years.

In an effort to "liberate" women from the shackles of family security, it appears the Baby Boomer generation forgot that what goes around, comes around.

Saturn's transit in Libra, and then, into Scorpio, from 2010 to 2015, is not a great time to be single, nor is it a time, especially for women to reject long-term relationships based merely on personal issues related more to the woman's conundrum than on what marriage is really about.

To understand how Saturn will function in Libra and Scorpio during the 2010s, let's look to the past, during the philosophical heydays of the Feminist Movement in the United States.

This series of quotes will show just how dysfunctional society has become over 30 years later in the midst of a global economic depression.

Saturn is about to crystallize relationships in a time of severe economic hardships. It has been written that this great recession is really a "man-cession" in the sense that the highest numbers of unemployed are males.

This does not bode well for women who are looking for men to have relationships.

Not only is competition for quality males fierce, but the fact that many men are underemployed or without work altogether is not positive for women and families in the least.

The divorce rate has skyrocketed among the Baby Boomer generation. More than half of all marriages end up in divorce. It is triple that of their parents' generation.

Is nothing sacred? Cardinal Crisis. Heavy Rains. Floods. Accidents. The Bad Economy. A Very Cold Winter.

And now significant personal relationships?

Consider,

Nature Doesn't Give Out Rain Checks

Commentary By Henry Makow, Ph.D.

What better example of stupid, self-defeating behavior than this advice from a veteran feminist?

In an article entitled "Marry Him" (Atlantic Monthly, March 2008) Lori Gottlieb advises her sisters to "settle"--marry anything in sight...and fast.

This kind of abject surrender, while satisfying in an "I told you so" way, is also sad.

Millions of women who outsourced their common sense and trusted the media, their teachers, their leaders and their society are now high-and-dry.

They were told they could have it all, but most can't.

There are three times as many single women in their 30's now than there were in the 1970's.

By the time these women have established their careers, many are too thread bare and hard bitten to marry, and the good men are all gone.

They are the victims of the most evil, most successful, social engineering program in history. It was designed to give women career instead of family. But until feminists acknowledge that they are victims of a cruel hoax, they won't be able to salvage whatever is left.

I'll elaborate later but first Ill give you a taste of the wisdom of a woman who says how she defines the word "pathetic."

MS The BOAT?

Ms. Gottlieb begins by describing a picnic where she and a friend (both mothers of sperm donor babies) are not feeling 'satisfied.'

They miss not having husbands. No doubt the children will miss not having fathers.

"Ask any soul-baring 40-year-old single heterosexual woman what she longs for in life...what she really wants is a husband..." Gottlieb confesses.

While she and her friends "still call ourselves feminists and insist we're independent and self sufficient ... every woman I know - no matter how successful and ambitious, how financially and emotionally secure, feels panic ... if she hits 30 and find herself unmarried."

Forget about true love, his annoying habits, his halitosis or abysmal sense of aesthetics.

Marriage, she has discovered, is about having a teammate, even if he's not the love of your life. She even recommends gays as possible mates.

How did she end up like this?

Too much "education" I imagine. Too much feminist empowerment and Hollywood-fueled expectations of romance and men.

Earlier in life, she dumped someone because, although they had "strong physical chemistry" and their sensibilities were similar, they proved to be "a half-note off, so we never quite felt in harmony, or never viewed the world through quite the same lens."

Apparently, she was looking for a clone.

"Now, though, I realize that if I don't want to be alone for the rest of my life, I'm at the age where I'll likely need to settle for someone who is settling for me.

"We lose sight of our mortality. We forget that we, too, will age and become less alluring. ...Which is all the more reason to settle before settling is no longer an option."

Take the date I went on last night.

The guy was substantially older. He had a long history of major depression and said, in reference to the movies he was writing, "I'm fascinated by comas" and "I have a strong interest in terrorists."

He'd never been married. He was rude to the waiter. But he very much wanted a family, and he was successful, handsome, and smart.

As I looked at him from across the table, I thought, Yeah, I'll see him again. Maybe I can settle for that.

But my very next thought was, maybe I can settle for better.

It's like musical chairs - when do you take a seat, any seat, just so you're not left standing alone?"

"But then my married friends say things like, 'Oh, you're so lucky, you don't have to negotiate with your husband about the cost of piano lessons' or 'You're so lucky, you don't have anyone putting the kid in front of the TV and you can raise your son the way you want.'

I'll even hear things like, 'You're so lucky, you don't have to have sex with someone you don't want to.'

"The lists go on, and each time, I say, 'OK, if you're so unhappy, and if I'm so lucky, leave your husband! In fact, send him over here!'

"Not one person has taken me up on this offer."

Did I say Pathetic?

My advice to single women in their 30's-40's is - Do Not Panic. Do not 'Settle.' You are far better off alone than with a misfit.

Also, whatever you do, do not have a child out-of-wedlock or from a sperm bank. That diminishes your chances of marriage big-time.

Gottlieb is desperate to 'settle' mainly because she has an infant on her hands.

The key thing to realize is that feminism was not spontaneous grass roots social change as portrayed.

It was social engineering designed to phase out gender, marriage and the nuclear family. There are half as many nuclear families now than there were in the 1960's.

The destruction of the family is part of a larger agenda to destabilize and depopulate society in advance of a thinly veiled totalitarian world government.

Sexual liberation is part of this agenda. Men see no reason to marry now that unfettered sex is so plentiful.

I advise women to consecrate sex for long-term loving relationships and end them in 6-8 months if marriage is not imminent. Don't waste time on window shoppers.

Feminists have been neutered by adopting the male role model and eschewing the feminine one. They need to rediscover their natural feminine instincts.

This involves finding a man they can believe in, and nurture, and not settling for less.

True love stems from the sacrifice that women make for the person they love.

Let him lead and keep quiet about all his faults. But don't let him take you for granted and dump him if he doesn't love you back (i.e look after your interests and needs.)

Generally speaking, the people behind elite social engineering are satanists in the sense they want to override God (Truth) and Nature. They deliberately do evil against humanity.

Women were designed to marry and have children in their late teens and early twenties. That's when they are irresistible to young men. They should marry men who have graduated and are starting their careers.

Raising children is not an afterthought. It is what married people do together, what they have in common.

It's natural growth, both biological and in terms of our personal development and fulfillment.

Nature doesn't give rain checks, as millions of women are discovering - the hard way.

~

The social stresses from the economic collapse will play a strong role in determining the strength of personal relationships over the next ten years.

Saturn's waning square to Pluto between the years 2010 to 2020 will feature a deep series of changes, challenges, and recriminations based on the corrupted, and highly-leveraged collateralized debt obligations (CDOs) which were packaged with literally tens of millions of mortgages that have since collapsed.

The effect on people, on society, on business in general is bound to be more than challenging unless new, positive, and creative means are applied along a broad spectrum along with practicality and common sense, to recover from the heady "bubble" years that started the mess to begin.

One of the sectors I have followed for many years is that of pensions.

It is my assessment, knowing the economic world transits, that many pension plans worldwide are on the verge of collapse.

click graphic to enlarge

This has occurred mainly because of very poor decisions by pension managers to play the stock market, and, of course, the major gaps are losses that came about in the wake of the real estate crash.

It not a wonder that this is so. Consider that some economists have estimated the Baby Boomer generation has lost somewhere near to $2.8 trillion in wealth in the economic crash as of August 2010.

This means two-thirds of all Boomers will now enter their senior years with little to no savings for retirement.

The promised pension benefits for public sector workers is like the economic Sword of Damocles hanging over many states and cities.

The Cardinal Crisis

Are Pensions Next To Collapse?

By EconomicCollapseBlog

22 Stats About America's Coming Pension Crisis That Will Make You Lose Sleep At Night

As the first of the 80 million Baby Boomers have begun to retire, it has become increasingly apparent that the United States is facing a pension crisis of unprecedented magnitude.

State and local government pension plans are woefully underfunded, dozens of large corporate pension plans either have collapsed or are on the verge of collapsing.

Social Security is a complete and total financial disaster and about half of all Americans essentially have nothing saved up for retirement.

So yes, to say that we are facing a retirement crisis would be a tremendous understatement.

There is simply no way that we can keep all of the financial promises that we have made to the Baby Boomer generation.

The truth is that we are all going to have to start fundamentally changing the way that we think about our golden years.

Once upon a time, you could count on getting a big, fat pension if you put 30 years into a job. But now pension plans everywhere are failing.

State and local governments are cutting back and are raising retirement ages. A majority of Americans have even lost faith in the Social Security system, which was supposed to be the most secure of them all.

The reality is that we are moving into a time when there is not going to be such a thing as "financial security" as we have known it in the past.

Things have fundamentally changed, and we are all going to have to struggle to stay above water in the economic nightmare that is coming.

Part of the reason we have such a gigantic economic mess on the way is because we have promised vastly more than we can deliver to future retirees.

When you closely examine the numbers, it quickly becomes clear that a financial tsunami is about to hit us that is going to be so devastating that it will change everything that we know about retirement.

The following are 22 statistics about America's coming pension crisis that will make you lose sleep at night....

Private Pension Plans And Retirement Funds

1 - One recent study found that America's 100 largest corporate pension plans were underfunded by $217 billion at the end of 2008.

2 - Approximately half of all workers in the United States have less than $2000 saved up for retirement.

3 - According to one recent survey, 36 percent of Americans say that they don't contribute anything at all to retirement savings.

4 - The Pension Benefit Guaranty Corporation says that the number of pensions at risk inside failing companies more than tripled during the recession.

5 - According to another recent survey, 24% of U.S. workers admit that they have postponed their planned retirement age at least once during the past year.

State & Local Government Pensions

6- Pension consultant Girard Miller recently told California's Little Hoover Commission that state and local government bodies in the state of California have $325 billion in combined unfunded pension liabilities.

When you break that down, it comes to $22,000 for every single working adult in California.

7 - According to a recent report from Stanford University, California's three biggest pension funds are as much as $500 billion short of meeting future retiree benefit obligations.

8 - In New Jersey, the governor has proposed not making the state's entire $3 billion contribution to its pension funds because of the state's $11 billion budget deficit.

9 - It has been reported that the $33.7 billion Illinois Teachers Retirement System is 61% underfunded and is on the verge of total collapse.

10 - The state of Illinois recently raised its retirement age to 67 and capped the salary on which public pensions are figured.

11 - The state of Virginia is requiring employees to pay into the state pension fund for the first time ever.

12 - In New York City, annual pension contributions have increased sixfold in the past decade alone and are now so large that they would be able to finance entire new police and fire departments.

13- Robert Novy-Marx of the University of Chicago and Joshua D. Rauh of Northwestern's Kellogg School of Management recently calculated the combined pension liability for all 50 U.S. states.

What they found was that the 50 states are collectively facing $5.17 trillion in pension obligations, but they only have $1.94 trillion set aside in state pension funds. That is a difference of 3.2 trillion dollars.

Social Security

14 - According to one recently conducted poll, 6 out of every 10 non-retirees in the United States believe that the Social Security system will not be able to pay them benefits when they stop working.

15 - A very large percentage of the federal budget is made up of entitlement programs such as Social Security and Medicare that cannot be reduced without a change in the law.

Approximately 57 percent of President Barack Obama's 3.8 trillion dollar budget for 2011 consists of direct payments to individual Americans or is money that is spent on their behalf.

16 - 35% of Americans over the age of 65 rely almost entirely on Social Security payments alone.

17 - According to the Congressional Budget Office, the Social Security system will pay out more in benefits than it receives in payroll taxes in 2010. That was not supposed to happen until at least 2016. The Social Security deficits are projected to get increasingly worse in the years ahead.

18 - 56 percent of current retirees believe that the U.S. government will eventually cut their Social Security benefits.

19 - In 1950, each retiree's Social Security benefit was paid for by 16 U.S. workers. In 2010, each retiree's Social Security benefit is paid for by approximately 3.3 U.S. workers.

By 2025, it is projected that there will be approximately two U.S. workers for each retiree.

20 - The shortfall in entitlement programs in the years ahead is mind blowing. The present value of projected scheduled benefits surpasses earmarked revenues for entitlement programs such as Social Security and Medicare by about 46 trillion dollars over the next 75 years.

21 - According to a recent U.S. government report, soaring interest costs on the U.S. national debt plus rapidly escalating spending on entitlement programs such as Social Security and Medicare will absorb approximately 92 cents of every single dollar of federal revenue by the year 2019.

That is before a single dollar is spent on anything else.

22 - Right now, interest on the U.S. national debt and spending on entitlement programs like Social Security and Medicare is somewhere in the neighborhood of 15 percent of GDP.

By 2080, those combined expenditures are projected to eat up approximately 50 percent of GDP.

For more - see the $2 Trillion Dollar Hole.

~

This waning square, along with Saturn's transit through Libra, Scorpio and Sagittarius over the next seven-and-a-half years, will reveal past levels of widespread greed and corruption that have been inherent over the years of the ruling establishment since 1993.

Please consider this:

How The U.S. Became A PR Disaster For Deutsche Bank

By Christoph Pauly & Thomas Schulz

Der Spiegel

The small city of New Haven, on the Atlantic coast and home to elite Yale University, is only two hours northeast of New York City.

It is a particularly beautiful place in the fall, during the warm days of Indian summer.

But this idyllic image has turned cloudy of late, with a growing number of houses in New Haven looking like the one at 130 Peck Street: vacant for months, the doors nailed shut, the yard derelict and overgrown and the last residents ejected after having lost the house in a foreclosure auction.

And like 130 Peck Street, many of these homes are owned by Germany's Deutsche Bank.

"In the last few years, Deutsche Bank has been responsible for far and away the most foreclosures here," says Eva Heintzelman.

She is the director of the ROOF Project, which addresses the consequences of the foreclosure crisis in New Haven in collaboration with the city administration.

According to Heintzelman, Frankfurt-based Deutsche Bank plays such a significant role in New Haven that the city's mayor requested a meeting with bank officials last spring.

The bank complied with his request, to some degree, when, in April 2009, a Deutsche Bank executive flew to New Haven for a question-and-answer session with politicians and aid organizations.

But the executive, David Co, came from California, not from Germany.

Co manages the Frankfurt bank's US real estate business at a relatively unknown branch of a relatively unknown subsidiary in Santa Ana.

How many houses was he responsible for, Co was asked?

"Two thousand," he replied. But then he corrected himself, saying that 2,000 wasn't the number of individual properties, but the number of securities packages being managed by Deutsche Bank.

Each package contains hundreds of mortgages. So how many houses are there, all told, he was asked again? Co could only guess.

"Millions," he said.

Deutsche Bank Is Considered 'America's Foreclosure King'

Deutsche Bank's tracks lead through the entire American real estate market.

In Chicago, the bank foreclosed upon close to 600 large apartment buildings in 2009, more than any other bank in the city.

In Cleveland, almost 5,000 houses foreclosed upon by Deutsche Bank were reported to authorities between 2002 and 2006.

In many US cities, the complaints are beginning to pile up from homeowners who lost their properties as a result of a foreclosure action filed by Deutsche Bank.

The German bank is berated on the Internet as "America's Foreclosure King."

American homeowners are among the main casualties of the financial crisis that began with the collapse of the US real estate market.

For years, banks issued mortgages to home buyers without paying much attention to whether they could even afford the loans.

Then they packaged the mortgage loans into complicated financial products, earning billions in the process -- that is, until the bubble burst and the government had to bail out the banks.

Deutsche Bank has always acted as if it had had very little to do with the whole affair. It survived the crisis relatively unharmed and without government help.

Its experts recognized early on that things could not continue as they had been going. This prompted the bank to get out of many deals in time, so that in the end it was not faced with nearly as much toxic debt as other lenders.

But it is now becoming clear just how deeply involved the institution is in the US real estate market and in the subprime mortgage business.

It is quite possible that the bank will not suffer any significant financial losses, but the damage to its image is growing by the day.

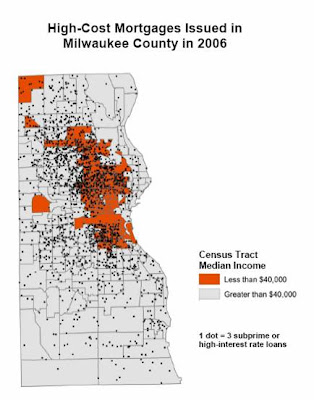

'Deutsche Bank Is Now in the Process of Destroying Milwaukee'

According to the Federal Deposit Insurance Corporation (FDIC), Deutsche Bank now holds loans for American single-family and multi-family houses worth about $3.7 billion (€3.1 billion).

The bank, however, claims that much of this debt consists of loans to wealthy private customers.

More damaging to its image are the roughly 1 million US properties that the bank says it is managing as trustee.

"Some 85 to 90 percent of all outstanding mortgages in the USA are ultimately controlled by four banks, either as trustees or owners of a trust company," says real estate expert Steve Dibert, whose company conducts nationwide investigations into cases of mortgage fraud.

"Deutsche Bank is one of the four" he says.

In addition, the bank put together more than 25 highly complex real estate securities deals, known as collateralized debt obligations, or CDOs, with a value of about $20 billion, most of which collapsed.

These securities were partly responsible for triggering the crisis.

In June 2010, Deutsche Bank CEO Josef Ackermann was publicly confronted with the turmoil in US cities.

Speaking at the bank's shareholders' meeting, political science professor Susan Giaimo said that while Germans were mainly responsible for building the city of Milwaukee, Wisconsin, "Deutsche Bank is now in the process of destroying Milwaukee."

As Soon as the Houses Are Vacant, They Quickly Become Derelict

Then Giaimo, a petite woman with dark curls who has German forefathers, got to the point.

Not a single bank, she said, owns more real estate affected by foreclosure in Milwaukee, a city the size of Frankfurt.

Many of the houses, she added, have been taken over by drug dealers, while others were burned down by arsonists after it became clear that no one was taking care of them.

Besides, said Giaimo, who represents the Common Ground action group, homeowners living in the neighborhoods of these properties are forced to accept substantial declines in the value of their property.

"In addition, foreclosed houses are sold to speculators for substantially less than the market value of houses in the same neighborhood," Giaimo said.

The speculators, according to Giaimo, have no interest in the individual properties and are merely betting that prices will go up in the future.

Common Ground has posted photos of many foreclosed properties on the Internet, and some of the signs in front of these houses identify Deutsche Bank as the owner.

As soon as the houses are vacant, they quickly become derelict.

A Victorian house on State Street, painted green with red trim, is now partially burned down. Because it can no longer be sold, Deutsche Bank has "donated" it to the City of Milwaukee, one of the Common Ground activists reports.

As a result, the city incurs the costs of demolition, which amount to "at least $25,000."

'We Can't Give Away Money that Isn't Ours'

During a recent meeting with US Treasury Secretary Timothy Geithner, representatives of the City of Milwaukee complained about the problems that the more than 15,000 foreclosures have caused for the city since the crisis began.

In a letter to the US Treasury Department, they wrote that Deutsche Bank is the only bank that has refused to meet with the city's elected representatives.

Minneapolis-based US Bank and San Francisco-based Wells Fargo apparently took the complaints more seriously and met with the people from Common Ground.

The activists' demands sound plausible enough. They want Deutsche Bank to at least tear down those houses that can no longer be repaired at a reasonable cost.

Besides, Giaimo said at the shareholders' meeting, Deutsche Bank should contribute a portion of US government subsidies to a renovation fund.

According to Giaimo, the bank collected $6 billion from the US government when it used taxpayer money to bail out credit insurer AIG.

"It's painful to look at these houses," Ackermann told the professor.

According to real estate experts, 85 to 90 percent of all outstanding mortgages in the United States are ultimately controlled by four banks, either as trustees or owners of a trust company. Deutsche Bank is one of the four. Criticized publicly for his company's role in the foreclosures, Deutsche-Bank CEO Josef Ackermann is pictured here.

Nevertheless, the CEO refused to accept any responsibility.

Deutsche Bank, he said, is "merely a sort of depository for the mortgage documents, and our options to help out are limited."

According to Ackermann, the bank, as a trustee for other investors, is not even the actual owner of the properties, and therefore can do nothing.

Besides, Ackermann said, his bank didn't promote mortgage loans with terms that have now made the payments unaffordable for many families.

The activists from Wisconsin did, however, manage to take home a small victory. Ackermann instructed members of his staff to meet with Common Ground.

He apparently envisions a relatively informal and noncommittal meeting. "We can't give away money that isn't ours," he added.

Deutsche Bank's Role in the High-Risk Loans Boom

Apparently Ackermann also has no intention to part with even a small portion of the profits the bank earned in the real estate business.

Deutsche Bank didn't just act as a trustee that -- coincidentally, it seems -- manages countless pieces of real estate on behalf of other investors.

In the wild years between 2005 and 2007, the bank also played a central role in the profitable boom in high-risk mortgages that were marketed to people in ways that were downright negligent.

Of course, its bankers didn't get their hands dirty by going door-to-door to convince people to apply for mortgages they couldn't afford.

But they did provide the distribution organizations with the necessary capital.

The Countrywide Financial Corporation, which approved risky mortgages for $97.2 billion from 2005 to 2007, was the biggest provider of these mortgages in the United States.

According to the study by the Center for Public Integrity, a nonprofit investigative journalism organization, Deutsche Bank was one of Countrywide's biggest financiers.

Ameriquest -- which, with $80.7 billion in high-risk loans on its books in the three boom years before the crash, was the second-largest subprime specialist -- also had strong ties to Deutsche Bank.

The investment bankers placed the mortgages on the international capital market by bundling and structuring them into securities.

This enabled them to distribute the risks around the entire globe, some of which ended up with Germany's state-owned banks.

After the crisis erupted, there were so many mortgages in default in 25 CDOs that most of the investors could no longer be serviced.

Some CDOs went bankrupt right away, while others were gradually liquidated, either in full or in part. The securities that had been placed on the market were underwritten by loans worth $20 billion.

At the end of 2006, for example, Deutsche Bank constructed a particularly complex security known as a hybrid CDO.

It was named Barramundi, after the Indo-Pacific hermaphrodite fish that lives in muddy water.

And the composition of the deal, which was worth $800 million, was muddy indeed. Many securities that were already arcane enough, like credit default swaps (CDSs) and CDOs, were packaged into an even more complex entity in Barramundi.

Deutsche Bank's partner for the Barramundi deal was the New York investment firm C-BASS, which referred to itself as "a leader in purchasing and servicing residential mortgage loans primarily in the Sub-prime and Alt-A categories."

In plain language, C-BASS specialized in drumming up and marketing subprime mortgages for complex financial vehicles.

However, C-BASS didn't just manage abstract securities. It also had a subsidiary to bring in all the loans that were subsequently securitized.

By the end of 2005 the subsidiary, Litton Loan, had processed 313,938 loans, most of them low-value mortgages, for a total value of $43 billion.

One of the First Victims of the Financial Crisis

Barramundi was already the 19th CDO C-BASS had issued. But the investment firm faltered only a few months after the deal with Deutsche Bank, in the summer of 2007.

C-BASS was one of the first casualties of the financial crisis.

Deutsche Bank's CDO, Barramundi, suffered a similar fate.

Originally given the highest possible rating by the rating agencies, the financial vehicle stuffed with subprime mortgages quickly fell apart.

In the spring of 2008, Barramundi was first downgraded to "highly risky" and then, in December, to junk status. Finally, in March 2009, Barramundi failed and had to be liquidated.

While many investors lost their money and many Americans their houses, Deutsche Bank and Litton Loan remained largely unscathed.

Apparently, the Frankfurt bank still has a healthy business relationship with the subprime mortgage manager, because Deutsche Bank does not play a direct role in any of the countless pieces of real estate it holds in trust.

Other service providers, including Litton Loan, handle tasks like collecting mortgage payments and evicting delinquent borrowers.

The exotic financial vehicles are sometimes managed by an equally exotic firm: Deutsche Bank (Cayman) Limited, Boundary Hall, Cricket Square, Grand Cayman.

In an e-mail dated Feb. 26, 2010, a Deutsche Bank employee from the Cayman Islands lists 84 CDOs and similar products, for which she identifies herself as the relevant contact person.

Trouble with US Regulatory Authorities & Many Property Owners

The US Securities and Exchange Commission (SEC) is now investigating Deutsche Bank and a few other investment banks that constructed similar CDOs.

The financial regulator is looking into whether investors in these obscure products were deceived.

The SEC has been particularly critical of US investment bank Goldman Sachs, which is apparently willing to pay a record fine of $1 billion to avoid criminal prosecution.

Deutsche Bank has also run into problems with the many property owners.

The bank did not issue the mortgages for the many properties it now manages, and yet it accepted, on behalf of investors, the fiduciary function for its own and third-party CDOs.

In past years, says mortgage expert Steve Dibert, real estate loans were "traded like baseball cards" in the United States.

Amid all the deal-making, the deeds for the actual properties were often lost.

In Cleveland and New Jersey, for example, judges invalidated foreclosures ordered by Deutsche Bank, because the bank was unable to come up with the relevant deeds.

Nevertheless, Deutsche Bank's service providers repeatedly try to have houses vacated, even when they are already occupied by new owners who are paying their mortgages.

This practice has led to nationwide lawsuits against the Frankfurt-based bank.

On the Internet, angry Americans fighting to keep their houses have taken to using foul language to berate the German bank.

"Deutsche Bank now has a real PR problem here in the United States," says Dibert.

"They want to bury their head in the sand, but this is something they are going to have to deal with."

~