Astrological Forecast

The U.S. General Election of 2024:

Will It Be Biden or Trump?

The Financial Markets:

Is The Federal Reserve Sending A Message On Interest Rate Cuts?

And,

China's Economic Woes About To Get Worse?

by Theodore White, mundane Astrolog.sci

As we near the Vernal Equinox of March 19-20th and the new solar year of 2024, I continue to highlight the importance of the planetary transits that take the world into the middle years of this decade of the 2020s.

We are nearing a new crossroads into the mid-2020s that will determine how we will live into the decade of the 2030s.

We are just months away from a Lunar Eclipse and Total Eclipse of the Sun after the 2024 Vernal Equinox of mid-March truly ushers in the new solar year 2024.

Can people learn to compromise together for the greater good - without rampant ideologies, murders, thefts, rape and migrant crime wave mayhem, the wars, hatred, cold hearts for one another and disdain for what is good and righteous?

Or, will some continue with their spiritual bankruptcy and ignorance, described so fittingly by an astrologer who was also an English playwright?

Though the wisdom of nature can reason it thus and thus, yet nature finds itself scourged by the sequent effects.

Machinations, hollowness, treachery, and all ruinous disorders follow us disquietly to our graves."

In this issue of Global Astrology, I examine the atmosphere of our times - and those to come - including the U.S. General Election of November 2024.

Here, I present the good reader with my forecast on the winner who will become the next President of the United States of America in 2025.

The U.S. General Election of 2024:

Will It Be Trump or Biden?

In a classic head-to-head race, Trump is ahead in a McLaughlin and Associates poll of likely voters by four points at 47 percent support, with about 10 percent undecided.

A poll by CNN poll released on February 1 also has Trump with a four-point lead, while YouGov recorded Trump ahead by one point in a poll of registered voters taken between January 24 and 30th.

Trump and Biden are likely to face each other in a rerun of the tumultuous 2020 presidential election in which Biden took the White House for the Democrats, ousting Trump and leading Trump and many voters to claim that the 2020 general election was rigged and stolen outright.

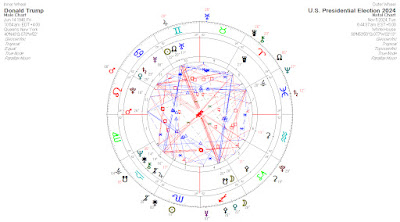

My analysis of the natal and secondary progressed charts of Joe Biden and Donald Trump as well as the planetary transits chart of Election Day on Tuesday, November 5, 2024 have led me to predict that Donald Trump will be elected President of the United States - again.

The astrological charts I cast and analyzed of Election Day 2024, as well as the charts relevant to the two major presidential candidates are presented in this edition of Global Astrology:

ELECTION DAY - NOVEMBER 5, 2024

WASHINGTON, DISTRICT OF COLUMBIA

DONALD TRUMP - NATAL CHART

Friday, June 14, 1946

DONALD TRUMP

Tuesday, November 5, 2024

Friday, November 20, 1942

SECONDARY PROGRESSIONS

JOSEPH BIDEN

Tuesday, November 5, 2024

JOSEPH BIDEN

JOSEPH BIDEN & DONALD TRUMP

78th SOLAR RETURN - DONALD TRUMP

June 14, 2024

82nd SOLAR RETURN - JOSEPH BIDEN

November 20, 2024

All these charts that I have cast and analyzed show that Donald Trump will win the 2024 General Election to become the 47th President of the United States of America.

Yet, President Biden declared that Americans would be living in a "nightmare" if former President Trump succeeds in winning re-election.

Biden decried Trump for running for president:

"We have to keep the White House. We must keep the Senate," Biden said, adding that only then "we can say we saved American democracy."

"Imagine the nightmare of Donald Trump," he said.

Meanwhile, Trump's own campaign responded with the same tone. Spokesman Steven Cheung declared that:

"Biden has been a nightmare for this country in just three short years in the White House, and no amount of gaslighting will make Americans forget about all the misery and destruction he has brought."

New Polls Say Black & Latino Americans To Choose Trump Over Biden in 2024

A new poll of 1,000 registered voters by NBC News found that Trump is far ahead of Biden by 23 points on whether either candidate has "the necessary physical and mental health to be president."

Additionally, a Gallup poll released on February 2nd, said that just 38 percent of voters say Biden deserves a second term. The figure is 12 percent lower than for Trump, who scored 50 percent in January 2020 in his reelection bid.

Voters have expressed serious concerns over illegal immigrants at the U.S.-Mexico border, inflation, the withdrawal from Afghanistan, and Biden's age - among other issues - putting Biden's estimated voter approval rating at just 38.9 percent, according to analysis website FiveThirtyEight.

Around 55 percent of American voters say that they disapprove of the Biden presidency.

The Gallup "early estimate" is not necessarily indicative of an overall election performance, however. Trump went on to lose the contested 2020 presidential election, while President George H.W. Bush's recorded a score of 49 percent before he lost the 1992 election to Bill Clinton.

So, it appears that Joe Biden's re-election strategy relies on arguing that Trump is a major threat to American democracy.

The White House's other strategies for stirring up support have largely failed, with "Bidenomics" falling flat and Americans deeply skeptical and angry of Biden's stance on illegal immigration and the border crisis.

Illegal immigration has become the number #1 issue nationwide and of particular interest is the declining support for Biden among Black voters - a critical constituency for Democrats.

Current polling shows that while Biden still enjoys support among Black voters overall, with 73 percent preferring him over Trump, his backing drops significantly among Black voters who favor Trump, those under the age of 34 - to just 60 percent.

Given the reality that Black Americans have supported Democrats at percentages exceeding 90 percent in times past, it is clear this new trend has placed quite an obstacle in the Biden's path to re-election.

Overall, as of February 2024, polls show Trump leading Biden by five percentage points - 47% to 42% - among registered voters in a hypothetical 2024 general election rematch.

So, the obvious questions are:

What is going on and why is this happening?

Well, the Biden administration has largely neglected Black American voters' concerns since the Democrats took over the Executive branch in 2021.

Yet Biden has championed other groups of Americans, such as illegal migrants and the LGBTQ community - even Ukraine seems to get more attention from the Biden administration than Black Americans.

Black voters are increasingly saying that President Biden and the Democrats have essentially signaled that they care more for the plight of people from foreign countries than addressing the domestic issues that affect the Black American lives and communities.

Another issue I have witnessed is the far left lurch and so-called 'woke' ideologies that the Democratic Party has made the Biden administration take into the White House and into their policies as well.

While Black Americans have traditionally supported Democrats, they are not necessarily progressive Leftists.

Black voters tend to be more moderate and even conservative on many issues. Moving further toward socialism is likely to turn off even more Black Americans.

There is no doubt that the numbers are clear and reveal a growing and widespread disillusionment with the Democratic Party.

For six decades, the Democrat party has enjoyed the unwavering support of Black Americans.

But more Black voters are saying that Democrats have taken their loyalty for granted - refusing to keep promises and continuing the same policies that have harmed Black Americans for decades.

This sentiment is particularly pronounced among younger Black voters, who do not have the same attachment to the Democratic Party that elderly Black voters do.

President Biden's struggle with keeping the support of Black voters is not his alone, but these new polls less than a year from the 2024 General Election show that the entire Democratic party is losing Black American support - and for good reasons.

'With Trump, We Had Money’:

What Black Voters Told MSNBC Spells Bad News For President Biden

“Donald Trump, in spite of all the craziness he may have in his head, reading some of the things that he talks about with business, I can kind of agree with as far as business-wise,” a voter named Thomas Murray said.

“I’m trying to grow my business. As far as Biden, I haven’t seen Biden really care about business like that.

And my concern is having my business so that I can build generational wealth, so my kids can see and have something to take upon when I’m not here.”

“Donald Trump has the reputation of being the money man,” a voter named Anthony Freeman noted.

Inflation and high interest rates have consistently plagued Biden’s presidency,

The Consumer Price Index, a broad measure of the prices of everyday goods including food and energy, rose 3.4% on an annual basis in December and 0.3% on a monthly basis, according to the Bureau of Labor Statistics.

The Federal Reserve decided to keep interest rates at a target range between 5.25% and 5.50% in late January 2024.

“A lot of people admire the persona, and they want to be him,” a voter named Juston Brown said. “They want to enjoy the perks that he has. He seems to always be able to circumvent the rules.”

Biden’s popularity with black voters has been declining, in multiple polls in recent months.

“We’ve only voted once for president. Trump is kind of all we know … Trump and Biden. They’re like, ‘well, we were broke with Biden. We weren’t with Trump.’

And that’s kind of the only thing that I’m hearing over and over again is that, ‘with Trump, we had money.’ "

In 2020, many Black American who voted for Donald Trump say that they remembered how they were insulted and ridiculed by those who, like Joe Biden, said that a vote for Trump meant that they "were not Black."

Black activists, especially those on the left, complain that the Democratic Party and its presidents, including former President Barack Obama, have taken their most steadfast base for granted, never fully delivering on their promises once they are in the White House.

They say: "Just look at the conditions of our communities. We have supported the party through decades, yet we languish at the bottom of most every measure of vitality - health care, education, employment, economic and business development, and public safety. Our urban communities are overrun with crime and gun violence."

This represents a tremendous shift in the political landscape, especially if Democrats fail to figure out how to win these voters back while the polls show that Donald Trump is gaining more Black voters as the general election approaches.

Who Will Trump Pick As His Vice-Presidential Candidate?

House Republican Elise Stefanik is the favorite to be Donald Trump's running mate in November, assuming he secures the party's presidential nomination, according to a leading bookmaker.

British company Betfair is offering odds of 9/2, or an 18 percent chance, on Stefanik sharing the ticket with Trump, ahead of South Dakota Governor Kristi Noem on 6/1, equalling 15 percent.

On Tuesday, Trump won the New Hampshire primary with 54.5 percent of the vote, ahead of second-placed Nikki Haley with 44.7 percent of the vote, according to AP.

Trump already came first in the Iowa caucus on January 15, after which Florida Governor Ron DeSantis dropped out of the race and endorsed him, making the former president the overwhelming favorite for the 2024 Republican presidential nomination.

After businessman Vivek Ramaswamy in the Betfair odds came former Trump-era Housing Secretary Ben Carson on 10/1, Haley on 11/1, Senator Tim Scott on 14/1, former Congressman Lee Zeldin on 22/1, Arizona Republican Kari Lake on 29/1 and DeSantis with 37/1.

And as the three (3) Jupiter-Saturn world squares get underway in August 2024 through to June-July 2025 that investors and traders should look to bet against stock market giants and other major companies the closer we get to the series of Jupiter-Saturn world squares.

My astrological analysis shows that in 2024 the inflation rate will fluctuate across countries and regions, depending on their economic conditions, policy responses, and external shocks.

According to the International Monetary Fund (IMF), the global inflation rate is projected to be 5.8% in 2024, with core inflation not expected to return to target levels of around 2% until 2025.

Okay, knowing all this going into 2024, it is my mundane assessment that 2024 is going to be a volatile year, - with presages by spring and then definite downturns through the second half of 2024 into the 2025 - over the course of all three (3) Jupiter-Saturn world squares.

Another series of planetary action in 2024, will be the start and finish of what will be three (3) Jupiter-Saturn world squares that will rotate around the Earth for nearly a year:

· 1st Jupiter-Saturn world square – August 19, 2024

· 2nd Jupiter-Saturn world square – December 24, 2024

· 3rd Jupiter-Saturn world square – June 15, 2025

Know that these world squares will affect financial matters as both Jupiter and Saturn are considered the major ‘business’ planets.

The Jupiter-Saturn world squares indicate that there will be expansion, growth and volatility financial markets, and so caution will need to be exercised in business operations so as to avoid indebtedness as economies of scale will tend to slow down.

Under the Jupiter-Saturn world squares, unemployment will tend to rise, as the atmosphere can see people go back and forth between optimism and pessimism in business.

During this 10-11 month span from August 2024 to June-July 2025 individuals will be faced with conflicts and moral crisis that involve cultural, ethical and spiritual decisions.

Generally, it is a time where there will be business, domestic and professional difficulties that will require preparation.

Watch for people who will neglect important responsibilities due to experiencing barriers in getting support from those in positions of authority, including from institutions.

This is one reason why the months from December 2023 through to June 2024 are vital in making certain that you are prepared enough going into the second half of 2024 and all of 2025, which is another major solar year with a series of Saturn-Neptune conjunctions to take place in 2025.

The major planetary transit at that time will be a Mars retrograde in tropical Leo (Dec. 6, 2024) then back into tropical Cancer (Jan. 6, 2025) and then Mars stations direct in tropical Cancer on Feb. 24-25, 2025 to return back to its retrograde point at 6-degrees Leo on May 1-2, 2025.

These eclipses and planetary transits from 2024 into 2025 reveal a world undergoing a gradual, but strongly paced change in times.

Nations and their populations will either evolve or devolve, but nonetheless, the transits of time as caused by their motions and configurations relative to the Earth.

Is The Federal Reserve Sending New Message On Interest Rate Cuts?

My forecast on the coming series of Jupiter-Saturn world squares that begin in August 2024 through to summer 2025 indicates a significant period in the global markets.

As explained before on Global Astrology, the year 2024 will see very interesting results due to the actions of the Federal Reserve Bank.

Fed Carson wrote:

"Federal Reserve officials made a concerted effort this past week to stress that Fed rate cuts will be slower and less aggressive than investors have been expected.

That message is starting to get through to Wall Street, though that didn't stop the stock market rally.

At the Dec. 12-13 Federal Reserve meeting, policymakers signaled that the central bank would cut rates three times in 2024, confirming a pivot from more Fed interest rate hikes.

But markets immediately expected six quarter-point rate cuts for the year, or 150 basis points, with the first cut coming in March 2024.

Several Federal Reserve policymakers (along with European Central Bank officials) have pushed back on aggressive rate cuts.

Fed Gov. Christopher Waller, stressed that the Fed should cut rates "methodically and carefully" and definitely not "rushed."

On Wednesday, Atlanta Fed President Raphael Bostic said he sees rate cuts starting in the third quarter. Meanwhile, San Francisco Fed President Mary Daly suggested policymakers must be "patient" about rate cuts.

All three officials are voting members of the Federal Open Market Committee in 2024.

As a recent of Fed jawboning, the odds of a March rate cut fell to 44.3% as of Friday morning, according to the CME FedWatch Tool.

As recently as Jan. 12, 2024 the markets saw an 81% chance of a Fed rate cut.

For the full year, markets now strongly expect five quarter-point rate cuts, with the odds of a sixth rate cut right at 50-50.

European Central Bank President Christine Lagarde and several other ECB policymakers signaled that a June 2024 rate cut was likely, but not before.

The central bank commentary, along with generally strong U.S. economic data, pushed up market rates.

The 10-year Treasury yield, which hit a record low of 3.785% on Dec. 27, moved decisively above the 4% level last week.

The 10-year yield jumped 20 basis points to 4.15%, clearing the 200-day line. The two-year Treasury bond yield, more closely tied to Fed policy, soared 27 basis points to 4.41%.

That's important, because ultimately Fed policy is about influencing market rates. Financial conditions had eased considerably since late October 2023 when the 10-year Treasury yield briefly hit 5%.

Yields are still well off those highs, but recoup some of their late 2023 losses.

The stock market rally initially retreated following the comments by Waller, Bostic, Lagarde and others, with the major indexes falling on Tuesday and Wednesday.

But markets revved higher, buoyed by Thursday's bullish 2024 guidance from chip foundry Taiwan Semiconductor. By Friday's close, the Dow Jones and S&P 500 hit record highs, while the Nasdaq set a two-year best.

Can the stock market continue to advance if Treasury yields keep rising? Notably, the 10-year yield hit resistance at its 50-day line on Friday, January 19th.

Early on Monday, January 22, 2024 the 10-year Treasury yield retreated to 4.10%.

The stock market has shown in recent years that it may shrug off rising Treasury yields for a time, but not indefinitely.

The European Central Bank holds its next policy meeting on January 25, 2024. The Federal Reserve's policy makers will meet on January 30-31st.

Mark Hulbert writes:

The U.S. stock market may be at an all-time high, but the “Wall Street – Main Street disconnect” remains wider than ever - and that spells trouble ahead.

Specifically, there’s a dramatic difference in perspectives about the health of the U.S. economy. On the one hand is Wall Street celebrating the stock market’s new records, with many believing the Federal Reserve has avoided a recession by executing a “soft landing.”

Yet, the average American is much more pessimistic.

I receive numerous emails from readers describing significant and sudden slowdowns in their particular industries and widespread fears in their communities of how much worse it could become in coming months.

And the data confirms what they’re saying.

One indicator that does a creditable job of capturing this disconnect is the difference between the Conference Board’s Consumer Confidence Index (CCI) and the University of Michigan’s Consumer Sentiment Index (UMI).

The CCI more heavily reflects consumers’ attitudes toward the overall economy, and so is more strongly correlated with the stock market and news headlines about “soft landings” and the like.

The UMI, in contrast, is more heavily weighted toward consumers’ immediate personal circumstances.

click on chart to enlarge

As you can see from the chart above, while this spread has narrowed slightly from its record high from a year ago, it nevertheless remains higher than ever historically. (Monthly data for the spread extend back to 1978.)

The chart also shows U.S. recessions, shaded in gray, according to the calendar maintained by the National Bureau of Economic Research.

As you also can see, a recession soon occurred on each prior occasion when the spread began to retreat from a new high. While it’s entirely possible that the U.S. will avoid a recession this time around, we shouldn’t forget that the four most dangerous words in investing are “it’s different this time.”

James Stack, editor of the InvesTech Research newsletter, who tracks the spread between the CCI and the UMI, recently summarized the economic tea leaves by writing that “it looks like a disastrous train wreck waiting to happen.”

He reminds us that in August 2007, just two months before that year’s bull-market high and four months before the beginning of the worst recession since the 1930s, Janet Yellen, then-president of the Federal Reserve Board of San Francisco and currently secretary of the Treasury, reported that the economy seems to be “on a glide path for the proverbial soft landing.”

click on chart to enlarge

Further evidence that a recession is not just possible but probable comes from the Conference Board’s Index of Leading Economic Indicators (LEI).

The latest reading of this index, released earlier this week, is the 21st month in a row in which the LEI has declined - the third-longest streak on record.

A recession occurred after every other streak of similar magnitude, as you can see from the chart above, courtesy of data from Bespoke Investment Group.

The bottom line? It’s not healthy for Wall Street to be celebrating while so many individuals are gloomy.

Booming stocks and cooling inflation have convinced 35% of Americans the economy is going well, but that is still not boosting President Joe Biden's approval polls.

Stocks are near record highs into February, and growth was surprisingly strong late last year.

The once-hot inflation has begun to cool as the Federal Reserve resists cutting interest rates until they feel that they are closer to achieving 2-percent level of inflation.

Still, Americans are feeling only slightly better about the economy.

Fortune magazine reported on the new poll from The Associated Press-NORC Center for Public Affairs Research found that 35% of U.S. adults call the national economy good.

That is an uptick from the 30% who said so in 2023, and up from 24% who said so a year ago.

While 65% still call the economy poor, that’s also an improvement from a year ago, when 76% called it poor.

The poll of 1,152 adults was conducted January 25–29, 2024, using a sample drawn from NORC’s probability-based AmeriSpeak Panel, which is designed to be representative of the U.S. population. The margin of sampling error for all respondents is plus or minus 4.0 percentage points.

Voters’ confidence in the economy could be a pivotal factor in this year’s presidential election as it is consistently rated as a top issue.

Recent data on the economy has shown that growth accelerated in 2022-2023 even as inflation returned closer to the Federal Reserve’s 2% target, proving wrong a multitude of Wall Street and academic economists who said a recession would be the consequence of efforts to lower inflation.

Still, from an astrological perspective, I continue to warn of the emerging series of Jupiter-Saturn world squares that begin in August 2024 and extend through to summer 2025 that will see a significant slowdown in the global economies of scale with recession.

President Joe Biden and his aides have taken to highlighting the economic positives as consumer sentiment has rebounded.

Biden is also drawing an open contrast with former President Donald Trump, the Republican front-runner. Trump supporters remember his tenure with pride for how the economy fared, but his term was marred by job losses tied to the coronavirus pandemic.

The evidence of a stronger economy has yet to spill over into greater support for Biden.

The newest polls puts his approval rating at 38%, which is roughly where that number has stood for most of the past two years. Biden’s approval rating on handling the economy is similar, at 35%.

Respondents interviewed for the survey often expressed their views on the economy through a personal lens.

Some judged it based on their grocery bills and prices at the gasoline pump. Others assessed the economy based on their appreciating investments.

Housing prices mattered, and so did job prospects for their adult children and the upward trajectory of the federal debt.

In February 2024, Fortune magazine quoted Molly Kapsner, 58, who lives on a farm in Wisconsin and who says she thinks the economy is doing “pretty well” because she has three children finishing college this year and all of them have job options. She voted for Biden in 2020 and plans to do so again.

“He has a lot on his plate right now and he’s doing quite well,” she said. “He’s just putting his head down and doing his job and not trying to create a circus in our country.”

David Veksler, who voted for the libertarian candidate, Jo Jorgenson, in 2020, said he’s worried about the rising federal debt. The 43-year-old software engineer manager from Denver said the borrowing will hurt growth in the long term, even if his investments are doing well now.

“I think he’s similar to his predecessors in furthering unsustainable deficits,” Veksler said of Biden. “I’m as negative on him as I was on Trump.”

Harry Broadnax, a 62-year-old retiree, said he increasingly thinks about the economy in relation to the increase in migrants illegally crossing the U.S. southern border. He feels their presence is diverting financial resources from U.S. citizens.

“I would like to see them block up the border like Trump wanted,” said Broadnax, who is from North Carolina, adding for emphasis, “I’m a Democrat.”

Broadnax doesn’t see himself voting for Biden or Trump, whose indictments worry him.

The Biden administration has tried to put a greater focus on the big numbers used to assess the overall economy, making its case through hard data.

Lael Brainard, director of the White House National Economic Council, told a group of reporters at the end of January 2024 that skeptics about the economy had overlooked how Biden’s policies boosted the labor market and repaired supply chains wrecked by the pandemic:

“The big miss here was not to understand how much, by surging back into the workforce, by addressing supply chains that were completely broken, those inflationary pressures would come down,” she said.

Donald Trump has said that the economy is “fragile” and “running off the fumes of what we did.”

Others claim that that overlooks the influence of the Federal Reserve, as well as the fact that average annual growth has been higher under Biden so far than it was during Trump’s term.

Still, there continues to be a political split in how people think about the economy.

As a consequence, there might be a limit on how much Biden’s approval numbers can climb even if the economy keeps thriving as it did last year.

Democrats remain far more likely than Republicans to describe the economy as good, 58% to 15% as some economic views have improved at least slightly since the same time last year, when 41% of Democrats and 8% of Republicans called the economy good.

Sixty-five percent of Democrats, but just 7% of Republicans, say they approve of Biden’s handling of the economy, both largely unchanged since late last year.

However, the poll did show a brighter outlook on the economy from some key voter demographics.

Since a year ago, a disproportionate increase in sentiment has come from college graduates and older adults - two groups that tend to turn out to vote at higher rates.

There is also the possibility that voters will care more about the personalities of the Democratic and Republican nominees than they do about the state of the economy.

Deborah Shields, 70, who works in direct sales, said she’s noticed an improvement in the economy as her investments have improved. Yet she said her opposition to Trump will determine her vote in November.

“I would never, never, ever vote for Trump,” said Shields, who lives in Orlando, Florida. “He’s a megalomaniac.”

Richard Tunnell, an Air Force veteran on disability, voted for Trump in 2020 and would do so again if the former president is on the ballot.

The 30-year-old from Huntsville, Texas is a hard “no” on Biden.

“He’s just a puppet,” Tunnell said. “They’ll boot people out like Trump who give a crap, but they’ll put in people like Biden who they can put on strings and manipulate.”

China's Economic Woes Deepen

By Theodore White, mundane Astrolog.sci

For years I have predicted and warned of China's overheated economy. Now, going into 2024 and the mid-2020s, China's economic viability is in crisis.

It means that any possibility China will overtake the United States as the world's largest economy is declining as the country faces what amount to an obvious slowdown.

While inflation soared immediately after the COVID-19 pandemic in the U.S., raising the cost of living and fueling fears of a recession, the American economy has proved resilient to the challenges of 2020-2023.

In the last quarter of 2023, the U.S. grew at a 3.3 percent rate, defeating expectations, and the country added more than 350,000 jobs.

This is because of a combination of factors that existed before the global pandemic:

China's aging workforce, its slowing internal demand, and the years-long crisis in the real estate sector, which drove China's explosive growth in the past few decades.

In a recent interview with Nikkei News Service, Cornell professor and former International Monetary Fund (IMF) official Eswar Prasad said that the economies of America and China - currently the first and second biggest economies in the world - have taken opposite trajectories, with the U.S. likely to maintain its growth while China continues to face structural problems like high public debt and a low birth rate.

"China faces a variety of fragilities, including undesirable demographics, a collapsing real estate market, deteriorating investor sentiment at home and abroad, and the lack of clarity over a new growth model," Prasad said.

"Even a 4 to 5 percent growth rate will be difficult to sustain over the next few years. The likelihood of the prediction that China's GDP will one day overtake that of the U.S. is declining."

China's market regulators have tried to stabilize the market by imposing restrictions that stop some investors from being net sellers of equities on certain days.

This strategy; with authorities offering what's known as "window guidance" in an attempt to help the country's stock market bounce back - was first introduced in October 2022.

Until recently, the regulators' restrictions appeared to be working as intended, as the benchmark CSI 300 stock index reported a 3 percent rebound in the final week of 2023.

But, that modest success was reversed in the first week of January 2024 as authorities were forced to remove limitations on some smaller mutual funds and on brokers in the face of increasing redemptions from customers, with the index now being down more than 4 percent.

Under pressure to stop share prices from free falling, the country's market regulators have already reintroduced restrictions on some securities companies - large institutional investors under pressure for years, then pressed more by the COVID-19 pandemic that began in China.

China's central bank, the People's Bank of China (PBOC) has been left with little room for maneuvering to strengthen the country's economy as the Chinese yuan has weakened in recent months and the bank is likely to want to avoid a further depreciation of the currency.

The yuan has already weakened more than 1 percent against the U.S. dollar this year.

On the other hand, the country's leadership has appeared reluctant to use state-run funds and financial institutions to buy up stocks massively and boost the national economy.

This apparent unwillingness to intervene has spooked foreign investors, with nine-tenths of money that had flowed into China's stock market from abroad in 2023 having left by the end of the year

On January 22, 2024, Newsweek reported this:

The Chinese stock market entered 2024 with more of a whimper than a roar, having lost a staggering $6.3 trillion since reaching its peak three years before.

Meanwhile, the world's second-largest economy continues to be buffeted by the same headwinds as the last few years, even after Beijing reported it had reached its goal of 5-percent GDP growth.

Investor confidence has been dampened by deflationary pressures, geopolitical uncertainties ahead of the 2024 U.S. elections, an economic slowdown, and a debt-laden real estate market in a country where 70 percent of household wealth is tied up in real estate.

As February 2024 approached, the Tokyo Stock Exchange surpassed Shanghai to become the largest in Asia in terms of market capitalization.

And in January 2024, Indian stocks surged, reaching a 157 percent valuation premium over their Chinese counterparts. This reflects a discernible shift in investor preferences between the world's second and fifth-largest economies.

COMMUNIST CHINA

MUNDANE NATAL

1 October 1949

The Hang Seng China Enterprises Index (HSCEI), an overall measure of mainland securities' performance in Hong Kong, has experienced a significant decline over the past five years, losing more than half of its value.

This downward trend continued last month, with the HSCEI dropping an additional 11 percent.

In my analysis of China's woes, we can take a look at how China's mundane natal has progressed into the present time:

COMMUNIST CHINA

MUNDANE NATAL: Secondary Progressions

Progressed to 10 February 2024

China's travails are bucking the global trend of resurging stocks buoyed by confidence in Wall Street amid an expected tech boom and expectations the U.S. Federal Reserve will cut interest rates.

The S&P 500 reached an all-time high last year, surging by 24 percent.

At the World Economic Forum in Davos, Switzerland, last week, China's No. 2, Premier Li Qiang, boasted the China's commitment to achieving its 5-percent GDP growth target without resorting to "massive stimulus," highlighting a cautious approach amid economic challenges.

Investors had been hoping for an interest cut on January 15, 2024 to give China's slowing economy a shot in the arm.

But they were disappointed when the country's central bank chose to maintain a medium-term policy rate.

COMMUNIST CHINA

MUNDANE SYNASTRY

NATAL & SECONDARY PROGRESSIONS

October 1949 Progressed to February 2024

click on chart to enlarge

This move likely contributed to a further dip in stocks and does little to attract foreign investors, who are already gradually backing away from the country.

Last year marked the first time in over a decade that foreign investment in China contracted.

A looming demographic time bomb has been cited as a future pitfall for the country's economy, as China, like its East Asian neighbors, is grappling with declining birth rates.

Financial analyst Mark Hulbert, however, suggests this demographic challenge "will not adversely impact Chinese equities for at least two decades, citing industry trends."

Still, George Magnus, once chief economist of UBS and now an associate at the China Center at the University of Oxford in the United Kingdom, previously told journalists that "this idea of China becoming the world's biggest economy may not happen, actually."

"The housing market crisis is not the only factor, there are a lot of things that are contributing to a much more pedestrian growth rate in the next 10 to 20 years.

I call them the seven Ds," he added.

"The Debt, in which the housing market obviously is included.

Demographics, with the Chinese population rapidly aging.

Decoupling and De-risking, which is a bit constraint on China's ability to develop the new economy and technology.

Directive, the government has become more controlling. And shortage of Demand."

But he says that the United States is faring much better in this post-pandemic era.

"While most major economies are struggling, the U.S. is consolidating its position as the driving force of the global economy," said Prasad.

"That said, I am a little concerned by the impact of the global economic slowdown," Prasad said:

"While U.S. GDP growth is not heavily dependent on exports, the sluggishness of other countries might be some drag. The increasing U.S. public debt and the increasing share of interest payments as a percentage of revenue are also significant concerns."

President Joe Biden, who's campaigning for reelection in November, recently took credit for the resilience of the U.S. economy, which he said is due to the success of his administration's economic policies, dubbed "Bidenomics."

"But our work is not done," Biden said in a speech in January 2024 after the Bureau of Economic Analysis released its latest data on GDP growth:

"I will continue to fight to lower costs - from implementing historic legislation to lower prescription drugs costs, health insurance premiums, and clean energy costs, to taking on hidden junk fees that companies use to rip off consumers, to calling on large corporations to pass on to consumers the savings they have been seeing for months now."

Meanwhile, going into the mid-2020s, it is becoming evident that China faces a crossroads when it comes to revitalizing its economy in the wake of the global pandemic.

With the Year of the Wood Dragon set to begin on February 10th, China's economy wobbled again on Monday, January 29, 2024.

A Hong Kong court ordered the winding-up of Evergrande, the world's most indebted real-estate developer, which has become synonymous with the country's ongoing property crisis.

"It is time for the court to say enough is enough," Justice Linda Chan said, noting Evergrande had failed to come up with a plausible restructuring plan for its $300 billion debt mountain.

Liquidators will now take over the company's assets - but it won't be easy for offshore investors to get their money back, according to analysts.

That's because Beijing will be keen to avoid re-inflating a debt-fueled property bubble that's pushed several Evergrande rivals including Country Garden to the brink of collapse.

Putting an end to that property-market crisis is just one economic headache policymakers will be trying to address this year.

Here are other reasons why China is bracing for a rough Year of the Wood Dragon in 2024:

In late 2022, China's Communist Party finally called time on its harsh zero-COVID measures - but the economy hasn't enjoyed the post-lockdown rebound many forecasters had predicted.

The economy expanded by 5.2% last year, according to official figures released at the end of January 2024 and while that figure narrowly topped Beijing's target of 5%, some economists believe it's unlikely there'll be a repeat performance in 2024 unless policymakers roll out stimulus measures.

"Economic activity in China has picked up in 2023, but the recovery remains fragile," the World Bank said at the end of last year.

Again, one symptom of the slowdown has been weaker consumer demand.

Sluggish spending is already hitting the bottom line for American companies such as Apple, which has logged disappointing iPhone 15 sales in China as shoppers cut back on big-ticket items.

Then there's deflation:

Falling prices are another source of China's economic woes. The consumer price index inflation gauge turned negative in October and has fallen every month since, according to official data.

Deflation might sound like good news for anyone in the West who's dealt with big jumps in the cost of living.

However, it leads to people choosing to hold off on buying things because they think that prices will get cheaper, creating a vicious cycle that drags down growth.

Japan was plagued by similar issues during the 1990s and 2000s, in a very lengthy period of economic stagnation.

Premier Li Qiang emphasized China's commitment to opening up last year, while US climate envoy John Kerry, Treasury Secretary Janet Yellen, and Tesla CEO Elon Musk all made high-profile trips to the Asian nation.

There's a simple reason for that "come and invest here" plea: that's because overseas investment has dried up.

Over the third quarter, China posted a foreign direct investment (FDI) deficit for the first time, signaling that Western companies and countries are pulling out their cash.

Economists have blamed Xi Jinping's iron fist for those declines.

The Chinese president made an obvious power grab at the Communist Party conference in late 2022, as he unveiled a new leadership team packed with political allies while publicly disrespecting his business-friendly predecessor.

In 2023, his government banned U.S. semiconductor maker Micron's chips, then he sent state police to the Shanghai offices of the American consulting giant Bain & Co., and pressed ahead with a crackdown on local Big Technology firms.

Under the mundane planetary transits since the outbreak of the COVID-19 pandemic that began in late 2019, and now in these post-pandemic years, Chinese equities are already having a hellish year.

As I pointed out, the Hong Kong's Hang Seng index has fallen by 8% and is trading close to its weakest level since 2009, while the benchmark CSI 300 has already dropped 5%.

The sell-off reflects investor concern about China's overall health, as well as Chinese tech companies falling behind their American rivals in the development of artificial intelligence.

Policymakers are reportedly weighing up rare market intervention measures to stop the rot - but their rescue packages could easily fail to put an end to a crash that has erased $6 trillion of shareholder value - just over the last three years.

None of that speaks to a dedication to the free market - so China will likely keep struggling to attract more foreign investment in 2024.

Copyright © 2007-2024 Theodore White

Excerpts may be republished with attribution in the body of the material. Please include the Global Astrology link to your site.